Advertisement

Advertisement

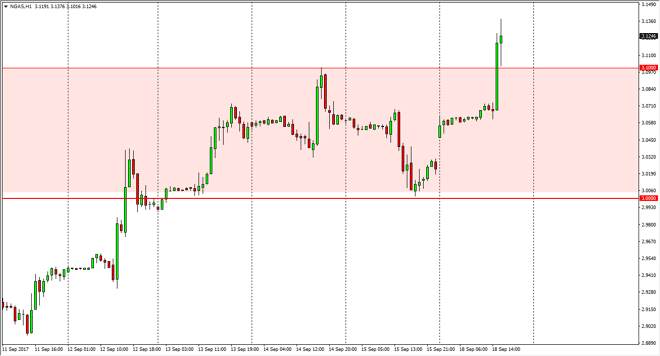

Natural Gas Price Forecast September 19, 2017, Technical Analysis

Updated: Sep 19, 2017, 05:54 GMT+00:00

Natural gas markets gapped higher at the open on Monday, and then later in the day finally managed to slice through the $3.10 level. Because of this, and

Natural gas markets gapped higher at the open on Monday, and then later in the day finally managed to slice through the $3.10 level. Because of this, and the fact that we have already pulled back to test that area for support, I believe that the natural gas markets are going to continue to go higher. This is a major breakout, and I believe that the $3.20 level above will be the short-term target. Short-term pullbacks should continue to be buying opportunities if we can stay above the $3.10 level, as the market has shown such bullish pressure and of course has cleared a massive barrier. On the other hand, if we fall below the $3.10 level, then I believe we will probably continue to see choppiness. I am not interested in shorting until we can break below the $3 level though, which is not going to happen today more than likely. Because of this, I believe that the volatility should continue to be intense, especially after the hurricane issues that we have had in the Gulf of Mexico, and the new hurricane that’s forming.

Buying the dips

On short-term charts, I believe that you can buy the dips, perhaps for short scalps. I think that’s going to continue to be the case until we break down below the $3.10 7 level, as the path higher from here is going to be very noisy and difficult for most traders. However, I think that a lot of headlines will move this market going forward, not the least of which will be whether and of course whether the temperatures are going higher or lower in the United States. With warmer temperatures coming, it seems to have stoked the idea of demand in the trading community.

NATGAS Video 19.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement