Advertisement

Advertisement

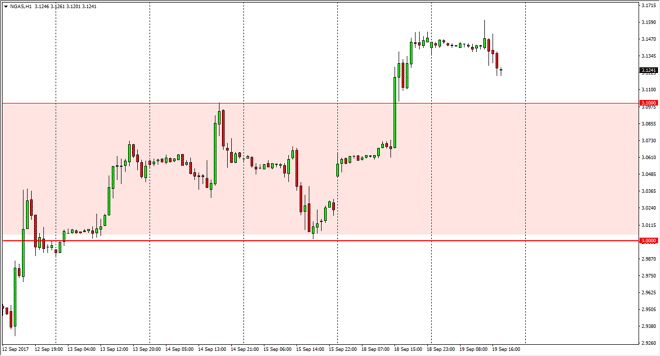

Natural Gas Price Forecast September 20, 2017, Technical Analysis

Updated: Sep 20, 2017, 04:47 GMT+00:00

With the recent breakdown in the natural gas markets, it’s very likely that the market will test the $3.10 level for support. As that level has been

With the recent breakdown in the natural gas markets, it’s very likely that the market will test the $3.10 level for support. As that level has been massive resistance, it makes sense that we will need to test this region for stability. If it holds, it’s very likely that the market will bounce towards the $3.20 level above. While I believe longer-term we have issues with oversupply, it’s likely that the short-term momentum should continue to send this market higher. Ultimately, I believe that this market will continue to be very volatile, and most of the noise will be somewhat unbearable for those who are overleveraged. Because of this, we may be likely to see sudden and drastic moves.

If we were to break down below the $3.10 level, it’s likely that we will find a significant support near the $3.00 level. A breakdown below there would be very negative for this market. Currently though, looks as if there is enough momentum to continue to push to the upside. I think that the 3.20 level is the beginning of the next major resistance, which should extend to the $3.25 level above there. Longer-term, I think it’s only a matter of time before the sellers return but the cyclicality of the market is somewhat bullish later this season. If that’s the case, we could see a bit of a pop. Given enough time, I think that the market returns to a selling position, but in the short term he certainly cannot fight this type of upward momentum. For short-term traders, this is an opportunity to pick up quick trades. For longer-term traders, it’s likely going to be a time of waiting for another selling opportunity in the future. The volatility should only increase from here.

NATGAS Video 20.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement