Advertisement

Advertisement

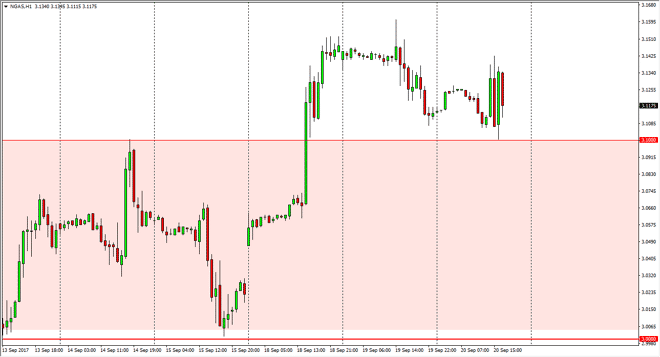

Natural gas Price Forecast September 21, 2017, Technical Analysis

Updated: Sep 21, 2017, 06:02 GMT+00:00

Natural gas markets have been very volatile during the Wednesday session, as we have tested the $3.10 level for support. So far, it has held, which is

Natural gas markets have been very volatile during the Wednesday session, as we have tested the $3.10 level for support. So far, it has held, which is what you would expect after a significant break out like we had a couple of sessions ago. At this point in time, I would suggest that perhaps that area should be an area that buyers are interested in, and that we should eventually grind higher. However, if we were to break down below the $3.10 level, we could go as low as $3.02 to fill the gap from 3 sessions ago. I think the one thing you can count on in the short term is going to be volatility, as a natural gas markets tend to be so anyway. This recent breakout has been significant, and I have more of an upward bias in the short term, although longer-term I thesis has not changed: we have a massive oversupply in this market.

Short-term trading only

In its present condition, I only trade the natural gas markets and the short-term time frames, because quite frankly it’s too difficult to hang onto a longer-term position. Ultimately, this is a market that should continue to grind its way towards the $3.20 level, and of course anything can happen as we have seen more than once in the natural gas markets. A break above the $3.20 level probably census market towards the $3.25 level, but that is going to be a difficult move to make. Having said that, we are getting warmer temperatures this time of year in the northeastern United States, and that of course drives of demand for natural gas to cool offices and homes. Longer-term though, the higher natural gas goes, the more fracking becomes a factor.

NATGAS Video 21.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement