Advertisement

Advertisement

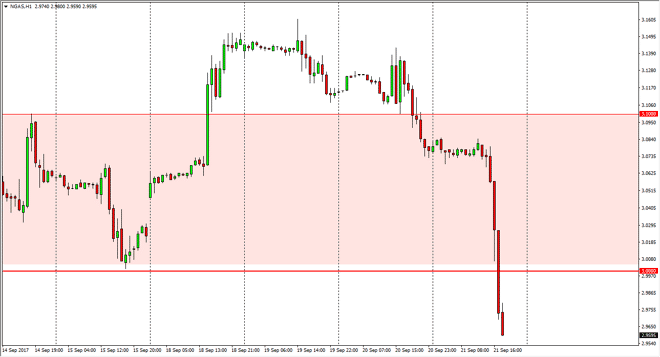

Natural Gas Price Forecast September 22, 2017, Technical Analysis

Updated: Sep 22, 2017, 06:48 GMT+00:00

Natural gas markets continue to be very volatile, and absolutely cratered during Thursday trading, breaking well below the $3 level as the inventory

Natural gas markets continue to be very volatile, and absolutely cratered during Thursday trading, breaking well below the $3 level as the inventory number came out larger than anticipated yet again. This is a market that every time it rallies, it has issues keeping those gains. We even managed to break above the vital $3.10 level recently, but now that is in the rearview mirror. Now that we are below the $3 level again, the sellers will probably come out on every rally, as even with hurricanes causing disruptions, natural gas supplies continue to be very large and under estimated. This has been a running theme for the last several years, and the market continues to be fooled.

Selling rallies

After this move, the only thing you can do if you choose to trade natural gas is to sell rallies as the signs of exhaustion return. At this point, I don’t know what it would take for the buyers to take over again, as I believe that a break above the $3.10 level would be that opportunity. We have clearly turned around yet again, and it now seems as if patient traders are simply making money by selling. This reminds me of the gold market in the 1980s, which was a simple “sell the rallies” type of market. If supply is so large, this market is going to continue to struggle to hang on to gains. Unfortunately, we have a structural oversupply issue that will be measured in decades, if not centuries in the United States and Canada, and that of course makes this a market that’s just waiting to be sold over the longer term. I believe that we will go looking for the $2.75 level again. Keeping a small position is probably the best way to deal with the volatility.

NATGAS Video 22.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement