Advertisement

Advertisement

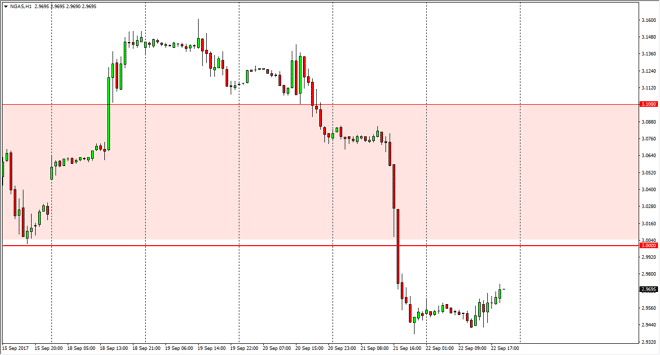

Natural Gas Price Forecast September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:05 GMT+00:00

Natural gas markets went sideways during most of the session on Friday, but found a bit of support near the $2.94 level. By bouncing slightly, it looks as

Natural gas markets went sideways during most of the session on Friday, but found a bit of support near the $2.94 level. By bouncing slightly, it looks as if we could go trying to test the $3 level above. However, I think that’s an area that will offer resistance, as it had been so important in the past. I think the given enough time, we will probably find sellers coming back into this market that had sold off rather drastically, as the inventories continue to build, even with hurricane damage. If we cannot build up value in the natural gas market right now, I don’t know when we can. Because of this, I remain bearish, and even though we broke above the vital $3.10 level recently, the buyers have all but abandoned this market. I find this particularly telling, and quite frankly I think that the volatility has done a great disservice to many people in this market. Given enough time though, I think that clarity will return, and that a “cell the rallies” type of attitude returns.

Because of the volatile nature of this market, it is more than likely a market that is going to demand that you remain very vigilant, and keep your position size small. I do think that selling is probably the easiest route, but I also recognize that there will be no easy trades in this market. As we head into a season that is typically better for natural gas, we still have a massive oversupply and I think that some market participants are slow to realize that. I believe that this is a structural problem, and it is only a matter of time before the sellers jump on any type of strength. Ultimately, I think we test the $2.75 level again.

NATGAS Video 25.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement