Advertisement

Advertisement

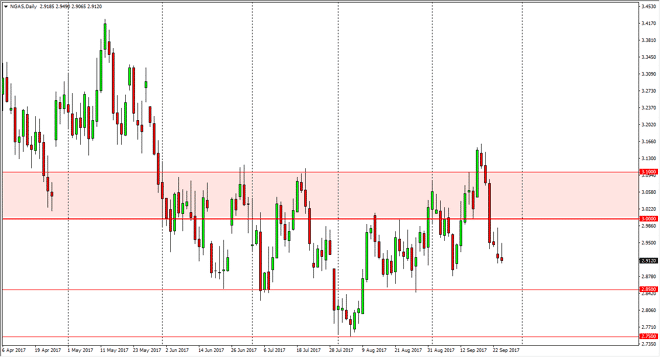

Natural Gas Price Forecast September 27, 2017, Technical Analysis

Updated: Sep 27, 2017, 05:30 GMT+00:00

The natural gas markets tried to rally during the session on Tuesday, but continues to find very bearish pressure above. The massive building inventory,

The natural gas markets tried to rally during the session on Tuesday, but continues to find very bearish pressure above. The massive building inventory, even during a couple of hurricanes, of course is a very negative sign for this market, and I believe that the overall attitude of the market should continue to be very soft. I see a massive amount of resistance above at the $3 level, and extending to the $3.10 level. If we did break above there again, that would be very bullish, but ultimately, I believe that the market should find sellers between here and there without too much trouble. I believe that the $2.85 level underneath should be massively supportive, but I also think that if we can break down below there, the market will crater and reach towards the $2.75 level.

Selling rallies

I continue to sell rallies on short-term charts, as the natural gas market simply cannot hang on to gains. I believe that the natural gas markets are inherently broken, and therefore there almost impossible to buy. I have found that time and time again that it is very difficult to try to go long of this market, because quite frankly there is so much in the way of trouble. The natural gas markets will continue to be oversupplied, quite frankly this is a situation that I don’t see changing in the next several years. Because of this, I have found this market to be reliable for sellers, and has been something that I’ve come back to more than once. Ultimately, the volatility will increase, so small position sizing is probably paramount although I certainly recognize that the downward pressure is much more significant than any upward pressure in the short term time frames.

NATGAS Video 27.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement