Advertisement

Advertisement

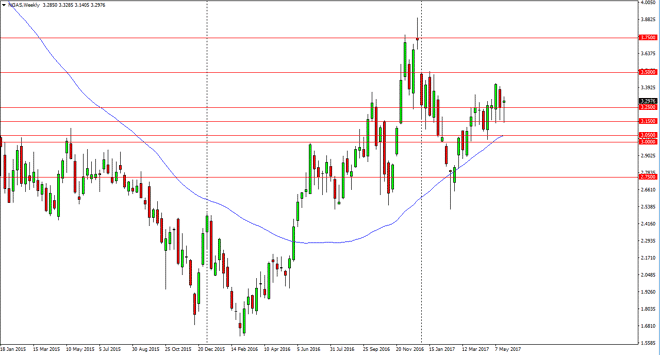

Natural Gas Price forecast for the week of May 29, 2017, Technical Analysis

Updated: May 27, 2017, 05:02 GMT+00:00

The natural gas markets initially fell during the week but found enough support near the $3.15 level to turn things around and in the forming a hammer for

The natural gas markets initially fell during the week but found enough support near the $3.15 level to turn things around and in the forming a hammer for the week. That is a very bullish sign, and it should also be pointed out that the Friday open was a gap higher, which of course is a very bullish sign as well. Ultimately, I believe that if we can break above the top of the hammer we should continue to go higher, perhaps reaching towards the $3.40 level initially, and then the $3.50 level after that. A break above that level should send this market to fill the gap, which has natural gas going all the way to the $3.74 level. While I believe that natural gas is going to remain volatile, I suspect this is where the longer-term traders are trying to get this market to go.

Buy-and-hold almost impossible

I believe that buy-and-hold is almost impossible in this market, unless you can do it with a small enough position size. There are a couple of things that could change this though, if you have the ability to trade CFD markets, or perhaps longer-term options. As far as futures are concerned, I think this market is far too volatile to be able to trade the contract as the swing between profit and loss will be too much for most people.

It looks as if the $3.15 level underneath is going to continue to offer massive support, so now, I believe that buying is the only thing you can do with any type of confidence. Ultimately, I don’t know if we can break above the $3.74 level, and quite frankly this point in time it doesn’t matter because of the volatility that we are seeing. The market now looks likely to be choppy, but with a long bias.

NATGAS Video 29.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement