Advertisement

Advertisement

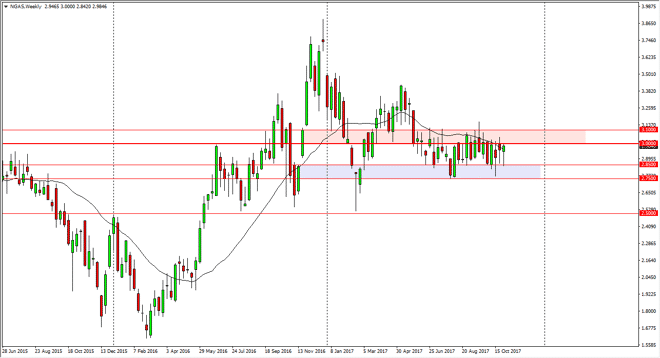

Natural Gas Price forecast for the week of November 6, 2017, Technical Analysis

Updated: Nov 4, 2017, 06:14 GMT+00:00

The natural gas markets fell during the week, reaching down to the $2.85 level below. As you can see on the chart, there is a significant amount of

The natural gas markets fell during the week, reaching down to the $2.85 level below. As you can see on the chart, there is a significant amount of support just below this level, as denoted by a purple box. The red box above is massively resistive, extending to the $3.10 level. I think that longer-term traders are going to need to wait for some type a significant break out before they can get involved, because quite frankly the oversupply in this market continues to play pricing, but we are starting to at least attempt to form a basing pattern on the longer-term charts. It’s likely that the markets will continue to be volatile for the short term, but we should eventually come up with some type of clarity. I think that a breakdown below the $2.75 level would be catastrophic, and send this market much lower. I don’t know that’s going to happen though, because clearly there is a lot of interest in that area. If we did breakdown below there, the $2.50 level would be the next target.

Alternately, if we get the break out to the upside, the market could go as high as the $3.50 level above where there would be quite a bit of resistance. A break above there sends the market looking towards the $3.85 level, which was the height from last year. We are heading into the coldest part of the year in America, so we could get a little bit of demand now, but the oversupply is so strong that I think any rally and natural gas should be looked at as a short-term phenomenon, because quite frankly the US fracking companies will flood the market once they are profitable, and they are very profitable above the $3 level.

NATGAS Video 06.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement