Advertisement

Advertisement

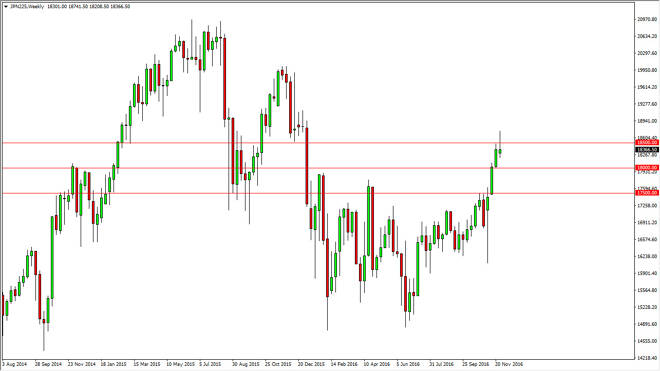

Nikkei 225 forecast for the week of December 5, 2016, Technical Analysis

Published: Dec 3, 2016, 03:59 GMT+00:00

The Nikkei 225 initially rallied during the previous week, breaking well above the ¥18,500 level. However, there was more than enough resistance above

The Nikkei 225 initially rallied during the previous week, breaking well above the ¥18,500 level. However, there was more than enough resistance above there to turn things back around and form a shooting star. Because of this, I think we could get a bit of a pullback at this point as the market is a bit overextended. I still believe in the bullish picture though, so given enough time the buyers should return. I believe that the 17,500 level below is essentially going to act as a “floor” in this market. Because of this, I feel that the market is one that you can only buy, and certainly this pullback could offer a nice buying opportunity for longer-term investors.

Alternately, if we can break above the top of the shooting star think that is also bullish sign but I would be concerned about the overbought condition of the market. The USD/JPY pair has been extraordinarily bullish, and needs a pullback. This particular index tends to mirror that currency pair, so pay attention to the USD/JPY pair as it pulls back. Sooner or later, we should get buyers involved in the market based upon value, and that should send this market rent back around. Given enough time, I do feel that’s what happens but it could be a bit choppy in the meantime. This is why I use the word investor: this is not necessarily a trade that you want to take on with a lot of leverage. However, CFD markets are perfect for this type of situation, as you can put a low leverage position on and then add once it goes in your favor. I think that’s probably the best strategy when it comes to both the Nikkei 225 and the USD JPY pair, as we have seen such a move to the upside to believe that the buyers are most certainly in control, but they need it to find more people to join the fray, and there is no better way to do that than to pull back and find value for newer traders.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement