Advertisement

Advertisement

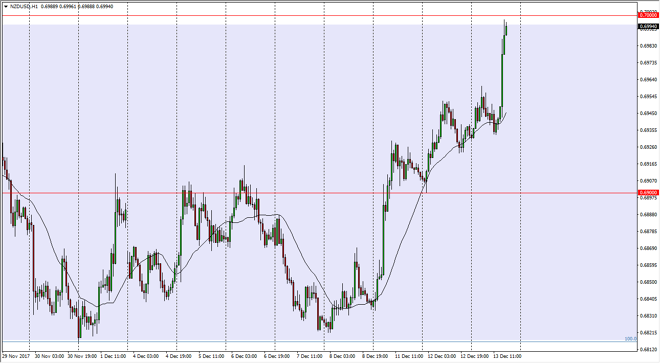

NZD/USD Price Forecast December 14, 2017, Technical Analysis

Updated: Dec 14, 2017, 05:58 GMT+00:00

The New Zealand dollar has rallied significantly during the trading session on Wednesday as the US tax bill seems to be in jeopardy.

The New Zealand dollar was initially choppy during the trading session on Wednesday, as we await the Federal Reserve announcement, and more importantly the statement. We have a started to rally towards the 0.70 level, an area that is massively resistive. Most of this reaction would have been due to Senator Flake suggesting that he was still questioning whether to sign the tax bill in the United States, putting tax reform in real jeopardy. Much of the US dollar rally has been due to the idea of tax reform, and therefore we could see a complete reversal of the trend if it does not happen. If we can close above the 0.70 level on the daily chart, the New Zealand dollar would break out of this short-term consolidation, and perhaps go looking towards the top of the longer-term consolidation which is near the 0.75 handle.

However, if we roll over from here, and find ourselves below the 0.6950 level, then the market will probably continue to go much lower. At that point, the 0.68 level underneath is massive support, and of course the bottom of the short-term consolidation. A breakdown below there, perhaps with an overly hawkish Federal Reserve statement, could send this market much lower. However, it looks as if the New Zealand dollar is trying to form a longer-term bottom, much to the dismay of US dollar bulls. By the time we get to midday on Thursday, we should have more clarity for the next move, but right now it looks like the 0.70 level is going to be the deciding factor for the next several sessions.

NZD/USD Video 14.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement