Advertisement

Advertisement

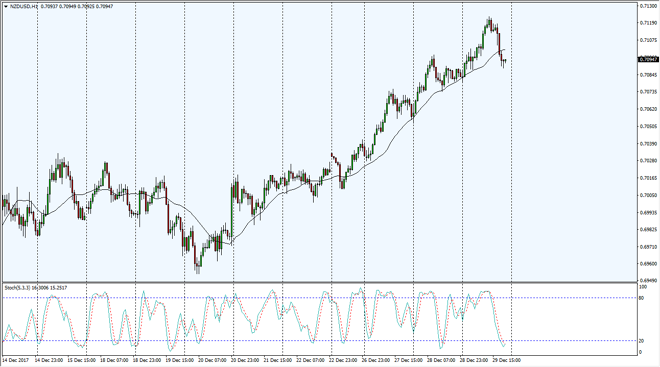

NZD/USD Price Forecast January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:13 GMT+00:00

The New Zealand dollar rallied initially during the trading session on Friday, but pulled back to give back almost all the gains. Because of this, we are currently sitting at the 0.71 level.

The New Zealand dollar initially tried to rally during the trading session on Friday, but found enough resistance near the 0.7125 level to turn things around, and then pull back to give back most of the gains. I think that the market pulling back is probably a sign of either exhaustion or the inability to hang on the gains due to a problem with volume. I believe that the market continues to be supportive longer-term, and as you look on the stochastic oscillator, you can see that we are in the oversold condition on the hourly chart, and it looks likely that we are ready to cross, and that of course is a bullish sign. I think that we will continue to find buyers on these dips, and that the New Zealand dollar will continue to find plenty of buyers as the kiwi dollar had been oversold for quite some time on the longer-term charts.

I believe that the 0.75 level above is the target, as it is the top of the recent consolidation area that we have seen, and I think that continues to be the case. If we can break above the 0.75 level, then I think we go much higher. At that point, we would break out to the upside, and I believe that the US dollar is getting hammered for a larger move against most currencies around the world. That should continue to favor the kiwi dollar overall, and ultimately, I think that we will see a reversal of that massive selloff recently.

NZD/USD Video 02.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement