Advertisement

Advertisement

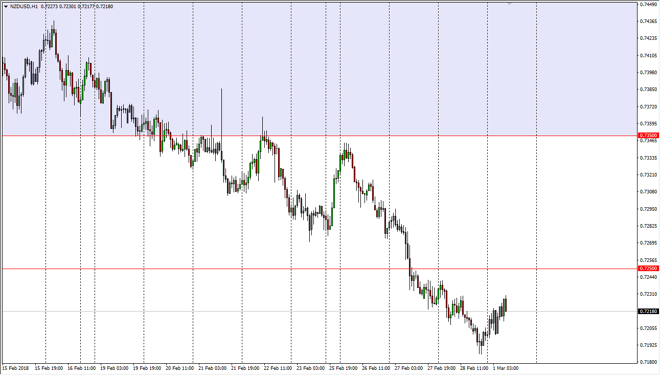

NZD/USD Price Forecast March 2, 2018, Technical Analysis

Updated: Mar 2, 2018, 05:35 GMT+00:00

The New Zealand dollar rallied a bit during the trading session on Thursday, as we found buyers just below the 0.72 handle. However, there is a small barrier above that could keep this market a bit tight.

The New Zealand dollar has gone higher during the trading session on Thursday, reaching towards the 0.7225 handle before rolling over again. It looks as if there is a lot of resistance above at the 0.7250 level as well, so at this point I think that if we can break above that level, the market could go much higher. Otherwise, there is support just below at the 0.7190 area, extensively the 0.72 handle. I think on a breakdown below there, the market could probably reach down towards the 0.70 level longer term, as it is the next major round number.

If we were to break above the 0.7250 level, the market probably goes to the 0.73 handle, followed very quickly by the 0.7350 level which was the bottom of the recent consolidation. Pay attention to the overall attitude of the market, as you continue to see the correlation between the New Zealand dollar and risk appetite in general. Especially the soft commodity markets, as they are representation of most of the New Zealand economy.

The US dollar of course has its part to play also, so I think that if the US Dollar Index is rolling over, by extension that should push this market higher as the US dollar will weaken. We have recently seen a lot of strength in the greenback due to higher interest rates coming out of the United States, but I think that has started to be priced into the market fully. Ultimately, I think that buyers will return given enough time.

NZD/USD Video 02.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement