Advertisement

Advertisement

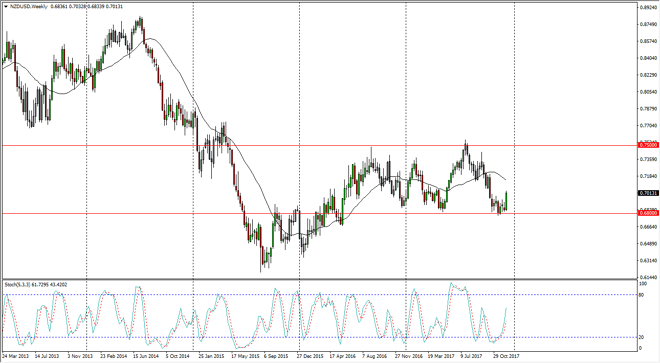

NZD/USD Price forecast for the week of December 18, 2017, Technical Analysis

Updated: Dec 16, 2017, 05:03 GMT+00:00

The New Zealand dollar rallied significantly during the week, bouncing from the bottom of the overall consolidation that we have been in for almost 2 years. Because of the strength of the candle, looks like the buyers are starting to take over again.

The New Zealand dollar rallied significantly during the trading sessions that made up this previous week, and it looks likely that a break above the top of the candle should send this market towards the 0.75 handle after that. That doesn’t mean that is can be easy, but I do think eventually we get to those higher levels. The New Zealand dollar has been beaten-down over the last couple of months, and I believe that we are starting to see value hunters come back in as the selloff was probably a bit overdone.

The stochastic oscillator has crossed over in the oversold area several weeks ago, and now it looks as if the buyers are starting to take over for the longer-term. The 0.68 level underneath continues to be a floor, and I think that the story of this next move will be a continuation of the several moves that we have seen. In general, this is a market that I think will be volatile, but then again, the New Zealand dollar almost always is. The market breaking above the 0.75 handle would be a major accomplishment, but probably something we wouldn’t see until later in 2018. If we were to break down below the vital 0.68 handle, the market probably goes looking towards the 0.63 level underneath, which is the scene of the absolute lows quite some time ago. Ultimately, I am bullish of the New Zealand dollar after this past week, but I also recognize that it’s not going to be an easy trade.

NZD/USD Video 18.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement