Advertisement

Advertisement

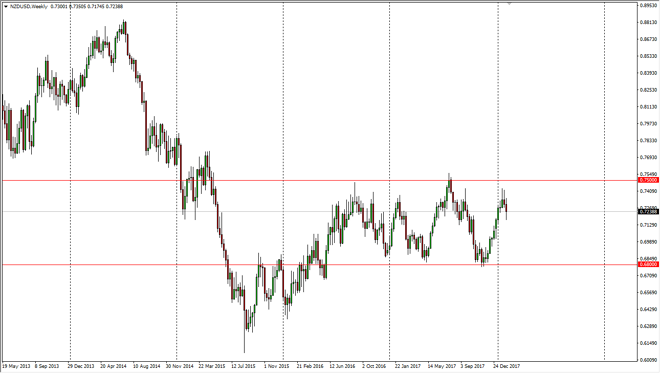

NZD/USD Price forecast for the week of February 12, 2018, Technical Analysis

Updated: Feb 10, 2018, 06:02 GMT+00:00

The New Zealand dollar had a negative week over the last 5 sessions, but that’s not a huge surprise considering that we had formed a couple of shooting stars previously on the weekly chart. We have seen the US dollar gain strength against many currencies during the past week, so of course the Kiwi wouldn’t be any different.

One of the most important aspects of the Kiwi dollar is that it is highly leveraged to commodities. The New Zealand economy is based on soft commodities, meaning that they export a lot of grains, meat, and the like to places like Asia. Essentially, the better Asia does, the better New Zealand does. However, this also makes the New Zealand dollar highly sensitive to risk appetite. When things become more risk adverse, the New Zealand dollar typically gets hit.

When I look at this chart, I recognize that we are trying to find a bit of fight in the Kiwi just below current pricing. That’s a good sign, as we are much closer to the top of the overall range of trading then we are the bottom. So, this sets up an easy observation: if we break down below the bottom of the range for this previous week, this pair should continue to drop significantly, as we continue to consolidate. However, if we don’t, it’s likely that we will make another attempt at the all-important 0.75 resistance barrier above. This is quite typical of currency pairs that are trying to build up enough momentum to make a breakout but trying to get in front of that move does carry its own risks. Only trade which are willing to lose if you want to try to anticipate a breakout, which I have found is a good way to lose money. However, if we get a clearance of the 0.75 handle, this market could go much higher.

NZD/USD Video 12.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement