Advertisement

Advertisement

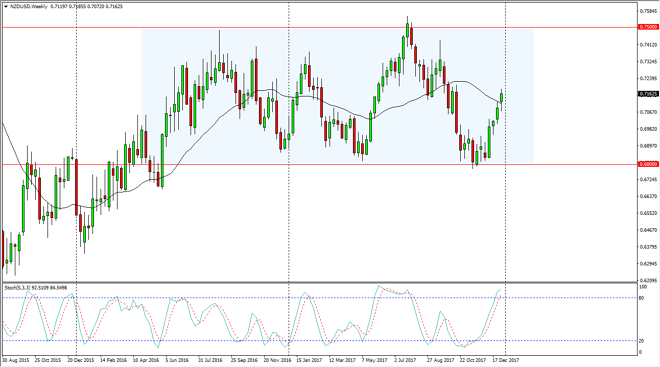

NZD/USD Price forecast for the week of January 8, 2018, Technical Analysis

Updated: Jan 6, 2018, 05:55 GMT+00:00

The New Zealand dollar gapped higher at the open of the week, but then turned around to find bearish pressure. We ultimately found support though, and at the end of the week, it looks as if the New Zealand dollar continues to be somewhat bullish.

The New Zealand dollar gapped higher at the open on Monday, but then turned around during the week to fall and fill that gap. By doing so, we found enough support and then bounced towards the upside. We ended up forming a bit of a hammer, and that hammer suggests that the buyers are returning. I think that the New Zealand dollar will continue to go towards the top of the overall consolidation area that I have marked on the chart, meaning the 0.75 level. The 0.68 level underneath was massively supportive, and essentially the “floor” in the pair. I don’t have any interest in trying to short this market, although I recognize that a breakdown below the bottom of the hammer for the week would be negative. Nonetheless, I believe that the 0.70 level will also be supportive, so therefore I think it’s only a matter of time before we go long.

If commodity markets can rally in general, I think that the uptrend should continue but we are a bit overbought at this moment, so I think that the possibility of a pullback is likely, but it should only offer value going forward as the US dollar looks very soft against most currencies around the world. The market continues to be noisy, but there is a significant amount of bullish pressure that should continue to be felt going forward. I believe that we will test the highs again, and then eventually break out.

NZD/USD Video 08.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement