Advertisement

Advertisement

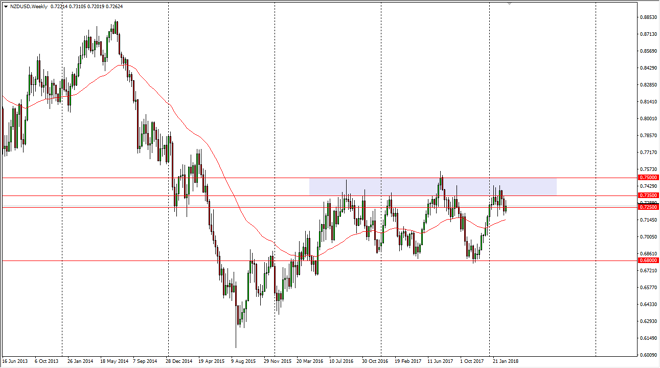

NZD/USD Price forecast for the week of March 12, 2018, Technical Analysis

Updated: Mar 10, 2018, 06:58 GMT+00:00

The New Zealand dollar was slightly positive during the week, as we continue to find support near the 0.72 region. The market looks as if it is trying to break out to the upside, but there’s obviously a lot of noise just above. I think we are going to continue to see a bit of choppiness over the next several weeks.

The New Zealand dollar has rallied a bit during the week, breaking above the 0.7250 level, but failing to break above the 0.7350 level. The market continues to be very noisy, and of course will struggle a lot with resistance just above. The 0.75 level is a major resistance barrier for longer-term traders overcome, and therefore I think it’s going to take a significant amount of momentum to finally break above there. Given enough time, I fully anticipate that we will, but in the short term it looks likely that we are going to go sideways overall. A breakdown below the 0.72 level would send this market down to the 0.70 level, and then possibly the zero point fixate level after that. Overall, this is a currency pair that tends to move with risk appetite, so pay attention to commodity markets and of course stock markets, as they give us an opportunity to measure risk appetite around the world. If they continue to climb overall, that should send this market higher.

Otherwise, if they fall, that could put in of bearish pressure to send this market looking for the lower levels underneath. Over the next couple of weeks, anticipate that this market will be making serious decisions, and of course we will be able to follow if we are patient enough to wait for the market to show its true direction.

NZD/USD Video 12.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement