Advertisement

Advertisement

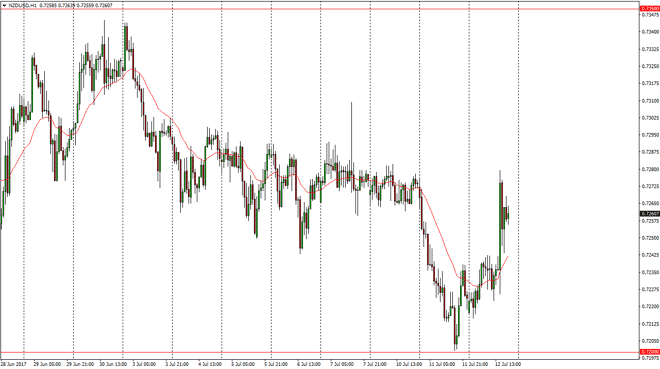

NZD/USD Forecast July 13, 2017, Technical Analysis

Updated: Jul 13, 2017, 06:56 GMT+00:00

The New Zealand dollar went sideways initially during the day on Wednesday, and then shot towards the next resistance barrier as Janet Yellen suggested

The New Zealand dollar went sideways initially during the day on Wednesday, and then shot towards the next resistance barrier as Janet Yellen suggested that interest rate hikes might be a bit slower than originally thought. That being the case, the market plowed into the 0.7275 level, which of course is an area where we have seen quite a bit of trading in the past. If we can break above the 0.73 level, then the market can go to the 0.7350 level afterwards. A break above there should continue to see the New Zealand dollar rallied towards the 0.75 level. The New Zealand dollar is one of the least liquid of the major currencies, so having said that I think that it is very likely that we will continue to see volatility and choppiness.

Dead money

I believe that currently this market is essentially “dead money”, meaning that it’s going to continue to be very choppy and difficult to deal with. After all, when we look at this pair it’s likely that the commodity markets and of course the risk appetite overall will continue to be a major focus in this currency pair. If we were to break down below the 0.70 level, the market should continue to go much lower, perhaps reaching towards the 0.70 level. Ultimately, I think that a bounce could send this market much higher, perhaps to the 0.7350 level above. A break above there should send this market looking towards the 0.75 level as I said before, which I think is even more important on longer-term charts. In the meantime, this is a market that I more than willing to stand on the sidelines for as there is very little in the way of movement longer-term that I see happening.

NZD/USD Video 13.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement