Advertisement

Advertisement

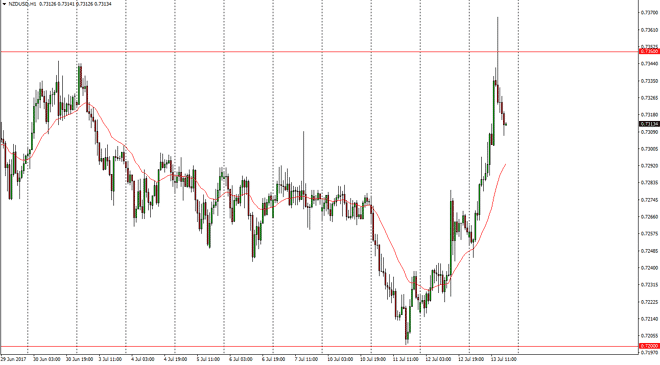

NZD/USD Forecast July 14, 2017, Technical Analysis

Updated: Jul 14, 2017, 05:28 GMT+00:00

The New Zealand dollar rallied during the day on Thursday, slamming into the 0.7350 level. We broke above there slightly, and then rolled over again as

The New Zealand dollar rallied during the day on Thursday, slamming into the 0.7350 level. We broke above there slightly, and then rolled over again as the resistance barrier continues to be very strange in. However, after the pullback it looks as if the buyers are coming back to try and support this market. I believe that if we can stay above the 0.7350 level, then it’s an opportunity to start buying as the market should then go looking towards the 0.75 handle above. Alternately, we could see a continuation of the volatility in general, and have the market looking for support near the 0.73 handle. Either way, I suspect that this market should continue to be very choppy, as the New Zealand dollar is thin as far as volume is concerned when it comes to major world currencies.

Waiting for the breakout

Although an argument to be made for buying the dips, I’m waiting to see the daily close above the 0.7350 level to take advantage of what should be a nice move momentum speaking. At that point, when you look at the longer-term charts the 0.75 level is very important, and that would be my target. I would pay attention to the commodity markets, as they have a massive influence on the New Zealand dollar, especially the agricultural futures. I believe that if we break below the 0.7275 level, the market will probably go down to the 0.72 level. Ultimately, market should continue to be volatile, but I believe that the buyers are starting to take advantage of what seems to be picked up momentum. I don’t think it’s to be easy, but currently it looks as if the New Zealand dollar is a lease trying to make a statement.

NZD/USD Video 14.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement