Advertisement

Advertisement

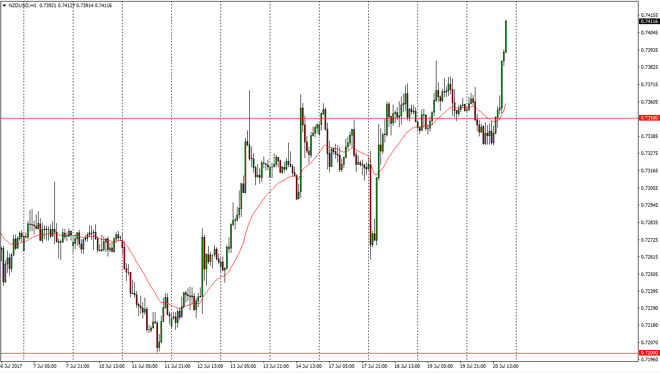

NZD/USD Forecast July 21, 2017, Technical Analysis

Updated: Jul 21, 2017, 05:27 GMT+00:00

The New Zealand dollar rallied during the day after initially falling on Thursday. The 0.7350 level seems to be an area where there is a significant

The New Zealand dollar rallied during the day after initially falling on Thursday. The 0.7350 level seems to be an area where there is a significant amount of support, and the fact that we broke above to the upside and in an impulsive manner suggests that we are going to continue to reach towards the 0.75 handle. I think that a pullback offers value, and that traders will get involved every time we pull back based upon the volatility in the US dollar. I believe that the New Zealand dollar is going to go looking for the 0.75 handle, so pullbacks should offer nice entry points for traders to get involved, if we get them. I believe that the 0.7350 level should offer a significant amount of support. If we can break above the 0.75 level, the market can go much higher and I think probably will.

Buying dips

I believe that buying dips will be the best way to go, as we continue to see the uptrend in the New Zealand dollar show signs of strength. I believe the commodity markets will help, as the US dollar has been sold off anyway, so that’s likely the driver of higher commodity prices, and then by extension a higher New Zealand dollar. The market continues to look bullish longer-term as well, so I have no interest in shorting, least not until we would break down below the 0.73 level, which is very unlikely to happen anytime soon, but if it did, I suspect that the market would then go looking for the 0.72 level underneath. There will be volatility, but I still believe that most of the recent action favors the buyers, and therefore I think that the market should provide plenty of trading opportunities over the next several sessions.

NZD/USD Video 21.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement