Advertisement

Advertisement

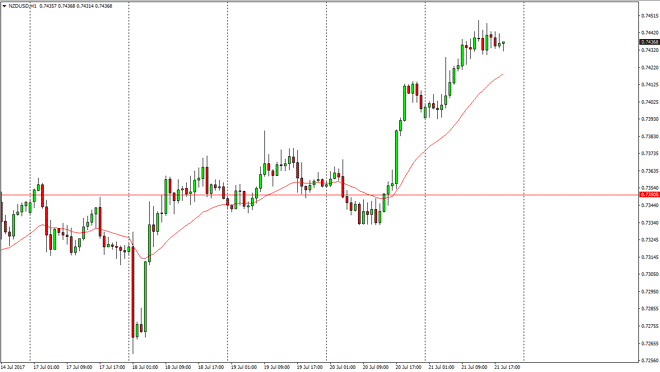

NZD/USD Forecast July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:02 GMT+00:00

The New Zealand dollar rallied during the day on Friday, as we continue to follow the 24-hour exponential moving average. The market tested the 0.7450

The New Zealand dollar rallied during the day on Friday, as we continue to follow the 24-hour exponential moving average. The market tested the 0.7450 level, and it now looks as if pullbacks will be buying opportunities. I think that the market should continue to reach towards the 0.75 level above, which is very important on longer-term charts. I think that pullbacks offer value the traders will be taken advantage of as the New Zealand dollar should continue to favor over the US dollar due to the swap rate. People are starting to suspect that the Federal Reserve is likely going to be slow to raise interest rates, so that should continue to favor the New Zealand dollar and its higher-paying yield.

Buying dips

I believe that every 50 pips, you can find support that will jump into the market and start to pick up the New Zealand dollar because it is “cheap.” With that being the case, I look at a buy on the dips type of mentality in the market, and I believe that the New Zealand dollar will continue to be valued. I don’t have any interest in shorting this market, because quite frankly the New Zealand dollar has been so resilient. We will get pullbacks of time to time obviously, but those should be short and shallow in nature.

NZD/USD Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement