Advertisement

Advertisement

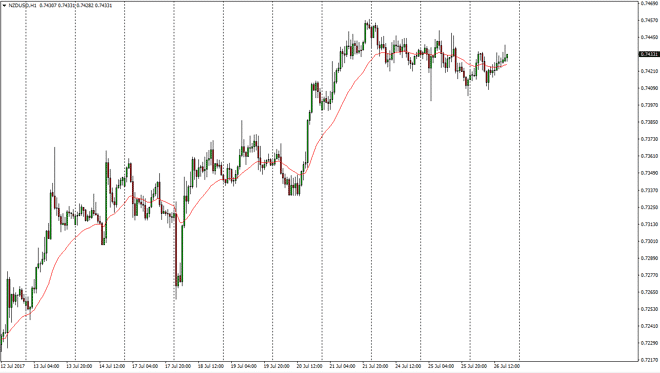

NZD/USD Forecast July 27, 2017, Technical Analysis

Updated: Jul 27, 2017, 04:40 GMT+00:00

The New Zealand dollar had a choppy session on Wednesday as the world waited the FOMC statement. Ultimately, there is very little expected to change, and

The New Zealand dollar had a choppy session on Wednesday as the world waited the FOMC statement. Ultimately, there is very little expected to change, and I believe at this point that the market will eventually try to go higher and reach towards the 0.75 handle. The 0.74 level underneath should be supportive, but a moot below there should send this market down to the 0.7350 level. With this, I believe that there is a lot of volatility just waiting to happen, but I would be cautious about going long the New Zealand dollar between now and the 0.75 handle.

Buying the breakout

The only trade that I have in mind at the moment is buying the break out in the New Zealand dollar, which would be a move above the 0.75 level on at least a one-hour chart, if not a daily chart. At that point, I would anticipate that the market should go looking towards the 0.77 level over the next several weeks. At the Federal Reserve looks to be a bit more dovish than initially thought, that should be reason enough for the New Zealand dollar to continue to rally. If we do breakdown below the 0.74 level, I think that there is plenty of support underneath and it will only be a matter of time before the buyers return. With this being the case, I expect a lot of volatility but I still also expect a longer-term upward bias. However, I think the between now and the resistance barrier there is so much in the way of noise that there’s no point in tying up any of your trading capital waiting on that break out. I would just as soon trade other markets if we are going to stay in this current range.

NZD/USD Video 27.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement