Advertisement

Advertisement

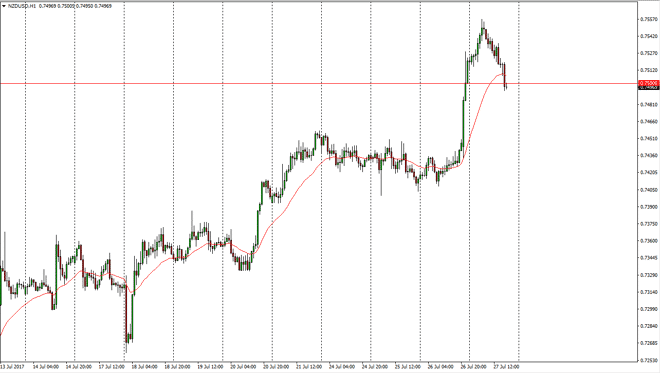

NZD/USD Forecast July 28, 2017, Technical Analysis

Updated: Jul 28, 2017, 04:56 GMT+00:00

The New Zealand dollar initially tried to rally during the day on Thursday, but turned around at the 0.7550 level. By doing so, we crashed into the 0.75

The New Zealand dollar initially tried to rally during the day on Thursday, but turned around at the 0.7550 level. By doing so, we crashed into the 0.75 handle, an area that has been rather interesting over the longer-term charts. I believe that the market will continue to find plenty of support in this area, but if we do breakout I think that the neck support level is closer to the 0.7450 level. Ultimately, I think that it’s easier to trade this market from a longer-term perspective, but you should be able to deal with quite a bit of choppiness and volatility. I think that if we can break above the 0.7550 level, the next target will be the round number of 0.76 above.

Buying dips

I continue to buy dips in the New Zealand dollar, unless of course we break down below the 0.74 level. At that point, I would assume that the New Zealand dollar is essentially “broken.” Ultimately, I think that longer-term we will see plenty of reasons for this market to go long, but currently it looks as if some profit-taking may be going on. The US dollar has seen a little bit of a reprieve during the day but after the massive selloff during the day on Wednesday, that’s not a big surprise that the US dollar would continue to see a little bit of support. Longer-term though, I don’t see a reason why the US dollar should continue to strengthen, so I believe that this will ultimately offer a buying opportunity for those who can deal with the volatility going forward. The New Zealand dollars considered a “risk sensitive currency”, so if stock markets rally, and of course commodities, this market should continue to go to the upside.

NZD/USD Video 28.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement