Advertisement

Advertisement

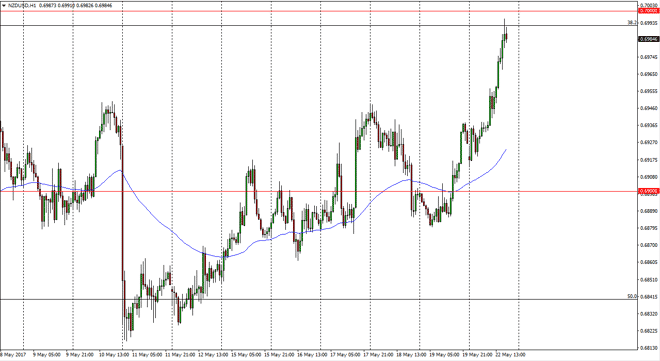

NZD/USD Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:05 GMT+00:00

The New Zealand dollar had an explosive moved higher after initially falling on Monday. We reach towards the 0.70 handle, a large, round, psychologically

The New Zealand dollar had an explosive moved higher after initially falling on Monday. We reach towards the 0.70 handle, a large, round, psychologically significant number that of course will attract a lot of attention. Because of this, rolling over and forming a shooting star on the hourly chart is not much of a surprise. I think that we will probably pull back, but there should be a certain amount of support underneath to keep the market afloat. I think that the 0.6950 level would be an excellent place to see buyers come back into the market, as it was resistive in the past. Alternately, we could break above the 0.70 level before doing that, which would be an impulsive sign of strength. The markets continue to look very choppy, and of course will be highly sensitive to commodity pricing as usual. The New Zealand dollar tends to be a bit of a “barometer” of commodity pricing in general so keep that in mind. The higher the commodity markets go overall, typically the better the New Zealand dollar does.

Risk on/risk off

Another feature of the New Zealand dollar is that it tends to be a risk appetite currency, meaning that as stock market prices go higher, so does the value of the kiwi dollar. I don’t like selling, I would rather see pullbacks looked at as value in a market that certainly seems to have broken out to the upside with a certain amount of significance. Ultimately, I think that we will break above the 0.70 level, but this pullback may be needed in order to find the momentum and volume necessary to do so. If we broke down below the 0.69 level, I would have to reevaluate the entire situation. However, that looks very unlikely.

NZD/USD Video 23.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement