Advertisement

Advertisement

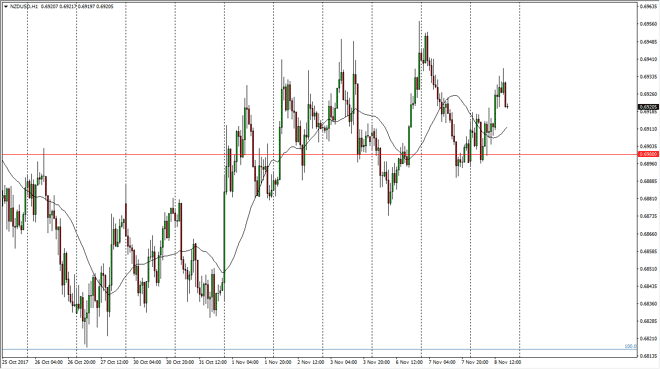

NZD/USD Forecast November 9, 2017, Technical Analysis

Updated: Nov 9, 2017, 05:20 GMT+00:00

The New Zealand dollar was very volatile during the trading session on Wednesday, eventually rallying towards the 0.6950 level. The market rolling over

The New Zealand dollar was very volatile during the trading session on Wednesday, eventually rallying towards the 0.6950 level. The market rolling over suggests that we are going to go back to the 0.69 handle, perhaps even breaking down from there. I think that the market will probably go looking towards the 0.68 level given enough time. The 0.70 level above is massive resistance, and I think it will be very difficult to break above there. After all, the commodity markets are not exactly on fire, and that of course has a negative influence on the New Zealand dollar. Lee little bit of a rally that we did have during the day is almost wiped out already, so I do not think that we have the ability to turn things around in the short term. We may get a bounce occasionally, but it is likely that we will continue to find sellers in general.

I believe that if we get some type of geopolitical risk or if stock selloff, this market should roll over rather drastically. If we were to break down below the 0.68 level, that should send this market down to the 0.65 handle after that, which is a very large structural support level on longer-term charts. Overall, this is a market that continues to look very bearish to me, and I do not have any interest in buying this market until we were to clear the 0.70 level, something that doesn’t look very likely to happen in the near term. Overall, I believe that the greenback will continue to show signs of strength, and this of course will have an effect on this pair as well, favoring the downside over the next several sessions, if not the longer-term as well.

NZD/USD Video 09.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement