Advertisement

Advertisement

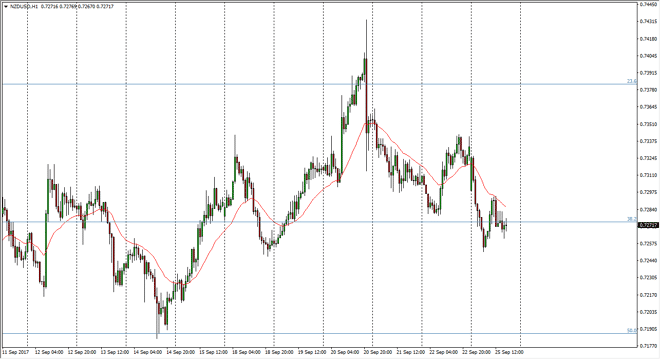

NZD/USD Forecast September 26, 2017, Technical Analysis

Updated: Sep 26, 2017, 05:00 GMT+00:00

The New Zealand dollar fell significantly during the session on Monday, breaking towards the 0.7250 level, before bouncing slightly. When I look at this

The New Zealand dollar fell significantly during the session on Monday, breaking towards the 0.7250 level, before bouncing slightly. When I look at this chart, I recognize that we could be forming a bit of a head and shoulders on the hourly chart, so we could see more bearish pressure. If we break down below the 0.7250 level, I think that this market may go looking towards the 0.72 handle next. Alternately, a move above the 0.73 level would be bullish and send this market looking for higher levels again. Keep in mind that the New Zealand dollar is sensitive to risk appetite, so stock markets and more importantly, commodity markets, can have a massive effect on what happens next with the kiwi dollar.

I think that the next couple of sessions could be rather volatile, but as the risk appetite continues to show an extraordinarily high amount of tolerance lately, it would not surprise me at all to see this pair continue to find buyers as stock markets and commodity markets around the world continue to find a reason to rally. Even when they don’t rally, they essentially don’t selloff that drastically, and in a sense, that’s the same thing. I believe that it will be volatile, but I suspect that there are plenty of people out there willing to pick up this pair at one point or another. Even if we did breakdown, I believe that is simply going to be a buying opportunity at lower levels given enough time and enough patience. I think that the 0.75 level will continue to be the longer-term target, but it may be very noisy on the way to that all-important level. Once we break above there, then it becomes more of a “buy-and-hold” scenario.

NZD/USD Video 26.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement