Advertisement

Advertisement

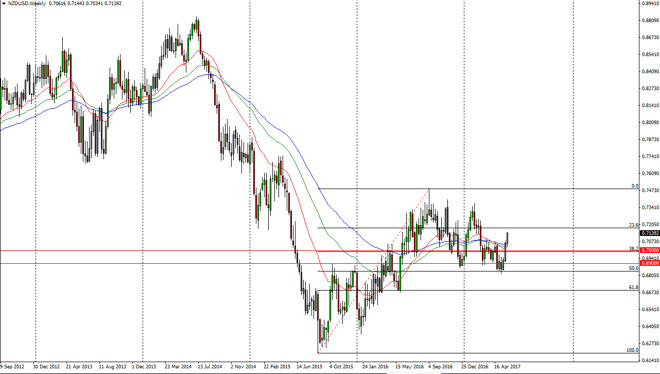

NZD/USD forecast for the week of June 5, 2017, Technical Analysis

Updated: Jun 3, 2017, 01:58 GMT+00:00

The New Zealand dollar had a very positive week, as we have broken above the 0.71 handle. However, I do see a bit of noise above so I don’t think it’s

The New Zealand dollar had a very positive week, as we have broken above the 0.71 handle. However, I do see a bit of noise above so I don’t think it’s necessarily going to be the easiest move to the upside. Nonetheless, it does look like the buyers are getting involved so selling is all but impossible for the longer-term trader. I believe that the 50% Fibonacci retracement level has offered enough support to turn the market back around and perhaps go gunning for the highs recently, that were made about a year ago at the 0.75 handle. A break above there obviously is very bullish we have a lot of work to do between now and then to get to that point.

Continued volatility and sensitivity

Looking at the market, I suspect that we will see continued volatility in general, but it appears that at least for the time being, the New Zealand dollar should continue to favor the upside. I think that the 0.70 level below will offer support, but the 0.72 level above will be a minor resistance. Above there we should then see the market go to the 0.7350 level, and then eventually the 0.75 handle.

The New Zealand dollar is very sensitive to risk appetite overall, not to mention the futures markets which drive the commodity sensitive currency. The currency is very sensitive agricultural commodities specifically, but also can serve as a barometer for the overall attitude of commodity markets in general. I believe that we will see a lot of choppiness, so it is probably still going to be easier to trade this market from a shorter-term market rather than the weekly chart as pictured here. Nonetheless, I believe that we will continue to see a lot of volatility.

NZD/USD Video 05.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement