Advertisement

Advertisement

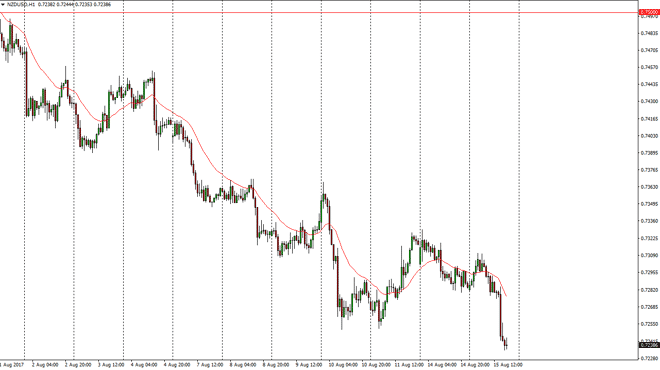

NZD/USD Price Forecast August 16, 2017, Technical Analysis

Updated: Aug 16, 2017, 04:22 GMT+00:00

The New Zealand dollar broke down during the session on Tuesday, slicing through the 0.7250 level. Because of this, the market looks as if it is ready to

The New Zealand dollar broke down during the session on Tuesday, slicing through the 0.7250 level. Because of this, the market looks as if it is ready to go lower, and I believe that the 0.70 level will be targeted next. Ultimately, if we were to break above the 0.7325 handle, then that would be a bullish sign. Currently, I think that the US dollar will continue to do reasonably well against commodity currencies, and of course the New Zealand dollar isn’t going to be any different. Because of this, I believe that we are much more likely to go to the 0.70 level underneath over the next several weeks. I don’t know that the volatility is going to push us that much lower and the short-term, but it certainly is a market that the sellers enjoy quite a bit of strength in.

Selling signs of exhaustion

I think waiting for short-term charts to rally and show signs of fading might be the best way to go. Ultimately, that should send this market to the downside, and rallies are to be looked at with serious suspicion. This was only exacerbated during the session on Tuesday as retail sales figures came out much stronger than anticipated. Ultimately, I don’t have any interest in buying currently, because I think that the market still has a lot to pricing, and that the US dollar has been beaten up so much, that there will be value hunters out there looking for an opportunity to go long the US dollar overall, and with so much uncertainty, it makes sense that a currency like the New Zealand dollar may be heard.

NZD/USD Video 16.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement