Advertisement

Advertisement

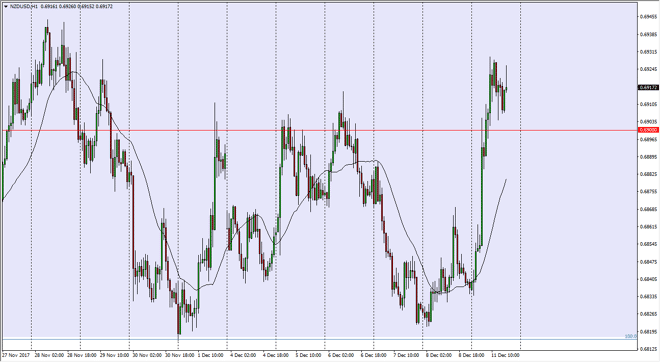

NZD/USD Price Forecast December 12, 2017, Technical Analysis

Updated: Dec 12, 2017, 06:04 GMT+00:00

The New Zealand dollar continues to be very noisy, but with the appointment of a new board member, it looks likely that the New Zealand dollar is going to benefit from a more hawkish member.

With the appointment of a new board member to the RBNZ, a Mister Adrian Orr, currency traders started to buy the kiwi dollar again, as a little bit of certainty has entered the market. We have broken above the 0.69 handle, which is a minor victory, but given enough time it’s likely that we will find plenty of resistance above, and Chinese economic numbers coming out this week could have an influence on where the New Zealand dollar goes next. Any type of negativity in the commodity markets could turn things around, perhaps sending this market down to the 0.68 level underneath which has been massive support level. I think a breakdown below the 0.68 level should send this market looking for the 0.65 handle after that. Ultimately, if we can break above the 0.70 level above, then the New Zealand dollar will have turned around effectively enough to perhaps reach towards the top of the longer-term consolidation area, which is as high as 0.75 over the last couple of years.

Regardless, I think we are going to see quite a bit of volatility as per usual with the kiwi dollar, and I think that the market participants are going to be trading more on news than structural levels, but I think that the overall downtrend is probably going to continue, as there are far too many concerns around the world, and of course rising interest rates in the United States. Because of this, it’s likely that the exhaustion will present to us a nice opportunity. If we can break down below the 0.69 level, then I think we will give back the gains.

NZD/USD Video 12.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement