Advertisement

Advertisement

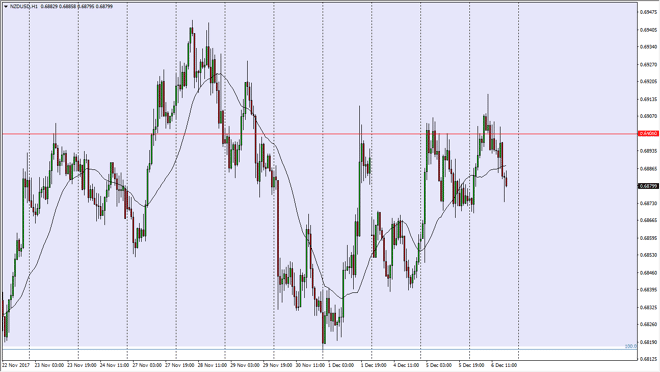

NZD/USD Price Forecast December 7, 2017, Technical Analysis

Updated: Dec 7, 2017, 06:01 GMT+00:00

The New Zealand dollar continues to be very noisy, as we initially tried to rally during the trading session on Wednesday. At this point, it looks like we are very susceptible to downward pressure.

The New Zealand dollar initially rallied above the 0.69 level, but ended up forming a shooting star on the hourly chart to turn around and fall from that level. The market looks likely to test the 0.6850 level, and a breakdown below there should send this market down to the 0.68 level next. That’s an area that is massively supportive, and therefore I think that a breakdown below that level would be very negative indeed, turning down to the 0.65 handle over the longer term. Alternately, we could break above the top of the shooting star during the day on Wednesday would show this market to be going higher, up to the 0.6975 handle, and eventually the 0.70 level above.

I believe that the 0.70 level should be a bit of a “ceiling” in the market, so a break above there would change everything. Currently I think there is quite a bit out there that could cause a bit of trepidation, and that of course sends this market looking for the US dollar over currencies such as the New Zealand dollar. Commodities of course have their influence on the New Zealand dollar, so therefore pay attention to the general attitude of futures markets, especially the soft commodities. Ultimately though, I think that we are simply trying to build up enough momentum to finally break down below the previously mentioned 0.68 handle support barrier below. At that point, I suspect that we will breakdown rather quickly, and that could throw fresh money at the US dollar. The volatility should continue, regardless.

NZD/USD Video 07.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement