Advertisement

Advertisement

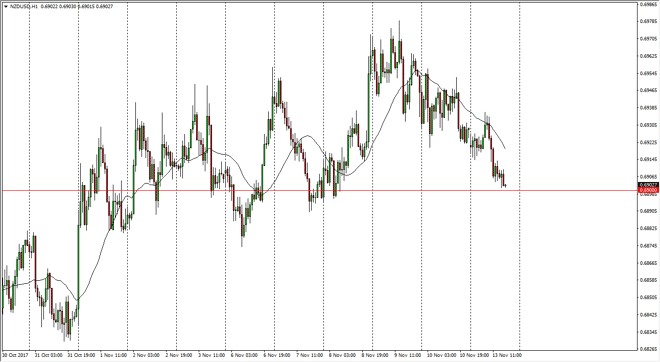

NZD/USD Price Forecast November 14, 2017, Technical Analysis

Updated: Nov 14, 2017, 04:42 GMT+00:00

The New Zealand dollar initially tried to rally on Monday, but the 24-hour exponential moving average continues to look reliable, as resistance. The 0.69

The New Zealand dollar initially tried to rally on Monday, but the 24-hour exponential moving average continues to look reliable, as resistance. The 0.69 level underneath is the beginning of significant support, so a little bit of a bounce initially would not be a big surprise. However, if we were to break down below the 0.6875 level, I think that the market should then goes down to the 0.68 level. Overall, this is a market that continues to struggle, as the New Zealand dollar is very sensitive to the commodity markets. I believe that the US dollar will probably continue to be stronger as we have more of a “risk off” attitude in the markets. Ultimately, I believe that the market will continue to find reasons to sell the New Zealand dollar, as the 0.90 level above is massively resistive.

When geopolitical issues arise, the US dollar tends to rally due to the US treasury markets, and of course military strength. Because of this, I think that the market continues to be choppy in general, but I still favor the downside either way. Even though I expect a bit of a bounce in the short term, I look at this is a potential way to pay less for a strengthening US dollar longer term. If we were to break above the 0.70 level, then the market could go to the 0.72 level, where I think there is even more interest in selling in that area. I think that the overall attitude of this market remains rather soft, but obviously we must look at both potential moves. If we were to break above the 0.70 level, the market should give you an opportunity to go long for the short term, with an eye on the overall softness longer-term that it appears we are seeing in the commodity currencies.

NZD/USD Video 14.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement