Advertisement

Advertisement

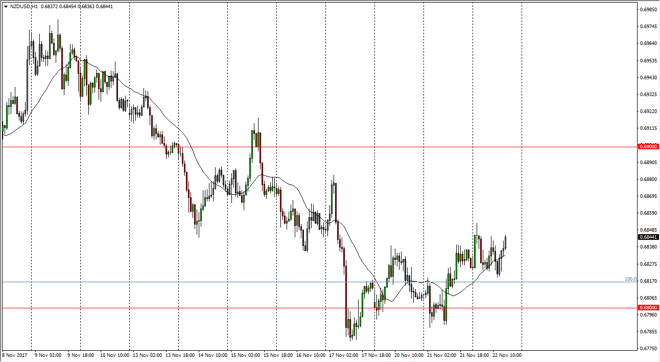

NZD/USD Price Forecast November 23, 2017, Technical Analysis

Updated: Nov 23, 2017, 05:01 GMT+00:00

The New Zealand dollar initially fell on Wednesday, but we found enough support at the 0.6825 level to bounce and continue the sideways chomp that we have

The New Zealand dollar initially fell on Wednesday, but we found enough support at the 0.6825 level to bounce and continue the sideways chomp that we have seen over the last couple days, although we do have a little bit of an upward bias. The 0.68 level underneath is a massive support level, so that’s not a huge surprise. I think that we are going to make some type of significant decision in this pair over the next several days, but I think the odds are that we continue to fall, as there are a lot of things weighing the New Zealand dollar down. Not the least of which is a reasonably soft commodity market, and of course Federal Reserve interest rate hike expectations. I also recognize the 0.69 level above as being massive resistance, so I don’t think that any move to the upside is going to be easily taken.

My anticipated trading strategy for this pair is to wait for signs of exhaustion and start selling. I recognize we may need to bounce from the 0.68 level a bit farther, as it typically will take more momentum to break down through a level like that. Once we do though, the market could very well go down to the 0.65 level rapidly, as it would be a major breach of support. If that happens, I would become aggressively short of the kiwi dollar. Alternately, if we could break above the 0.6915 region, the market probably goes looking to the 0.70 level, which of course is structurally and psychologically important from both directions. In general, I am very leery of buying the kiwi dollar right now, I think that the recent selloff is a sign of the general attitude when it comes to commodity currencies.

NZD/USD Video 23.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement