Advertisement

Advertisement

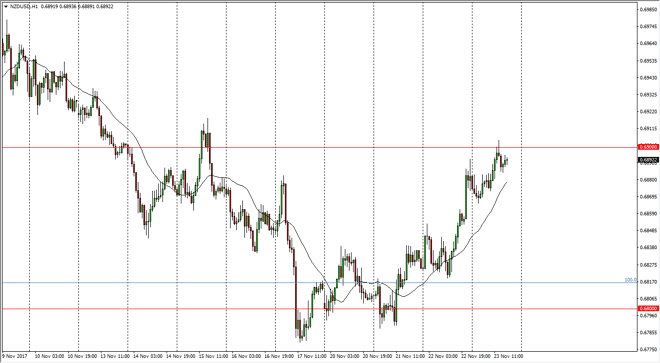

NZD/USD Price Forecast November 24, 2017, Technical Analysis

Updated: Nov 24, 2017, 05:04 GMT+00:00

The New Zealand dollar had a bit of a rally during the trading session on Thursday, testing the 0.69 level for resistance. We did find it, and pulled back

The New Zealand dollar had a bit of a rally during the trading session on Thursday, testing the 0.69 level for resistance. We did find it, and pulled back slightly. It looks as if we may return to the downward pressure and downtrend if we can break below the 0.6860 handle. At that point, the 24 hour exponential moving average will have flipped again, and it looks like we may be building up momentum to break down below the 0.68 handle underneath. A move below that level and substantial follow-through could send the New Zealand dollar down to the 0.65 handle over the longer term. However, keep in mind that the United States is currently in the midst of one of his biggest holidays of the year, so liquidity will be thin during that timeframe. The US dollar was left a bit undefended during the day, but I have to say that I’m not overly impressed by the rally that the kiwi managed.

Ultimately, I think that we will continue to go lower, and that it’s only a matter of time before we break down. With the Federal Reserve looking a raise interest rates later in the year, this makes quite a bit of sense, and I think that the 0.65 thing will more than likely happen. However, if we were to break above the 0.6920 level, then we probably need to go to the 0.70 level next to go looking for substantial selling pressure. This market has a lot of concerns, not the least of which is New Zealand itself, as there are a lot of concerns about overspending buy a new Labour government. Ultimately, I believe in selling the rallies going forward and what has been a very substantial move to the downside.

NZD/USD Video 24.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement