Advertisement

Advertisement

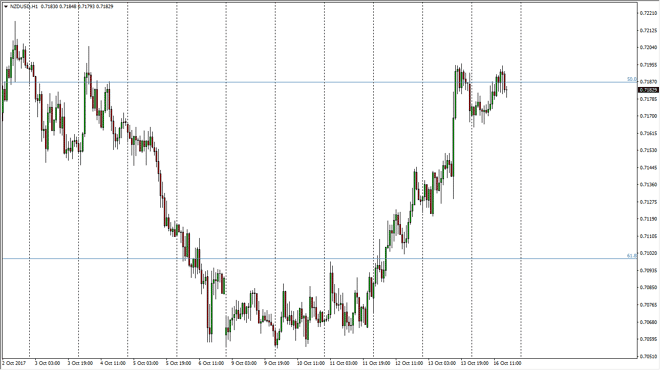

NZD/USD Price Forecast October 17, 2017, Technical Analysis

Updated: Oct 17, 2017, 06:01 GMT+00:00

The New Zealand dollar rallied initially during the day on Monday, reaching towards the 0.72 level but found enough resistance there to pull back again.

The New Zealand dollar rallied initially during the day on Monday, reaching towards the 0.72 level but found enough resistance there to pull back again. Given enough time, I do believe that we break out to the upside, especially in stock markets continue to rally, as we recognize that the New Zealand dollar of course is highly sensitive to risk appetite around the world. I think that once we break above the 0.72 level, the market will probably go looking towards the 0.7250 level next, followed by the 0.73 level. Ultimately, this market continues to show signs of choppiness, but I certainly believe that the recent action has been bullish, and shows that we are starting to pick up quite a bit of momentum. I think that the US dollar could continue to struggle in general, that of course will favor commodity currencies, as it gives a sign that risk appetite is picking up.

I recognize that the 0.7150 level below is supportive, just as the 0.71 level is. Ultimately, I think that we will break out to the upside but it is going to be very difficult to hang on to this market in the short term. I believe that the 0.71 level underneath is the beginning of a massive “floor” in the market, so pullbacks offer value. I believe that the major resistance in the market is currently at the 0.75 handle, so it will take quite a bit of momentum building to get above there. I expect a choppy yet positive market over the next several weeks, and look at these pullbacks as an opportunity to add to a longer-term position. If we were to break down below the 0.70 level underneath, then that changes everything, but it seems unlikely to happen.

NZD/USD Video 17.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement