Advertisement

Advertisement

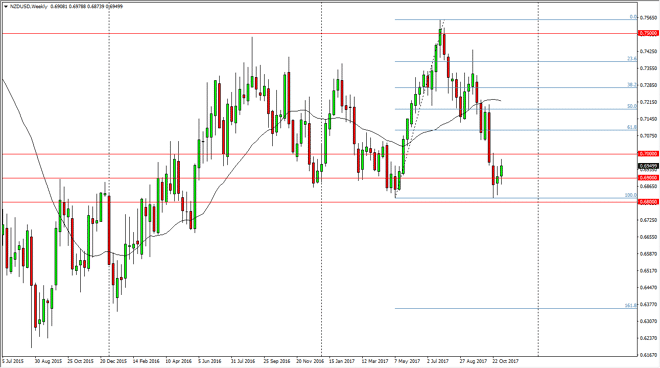

NZD/USD Price forecast for the week of November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:10 GMT+00:00

The New Zealand dollar initially fell during the week, but turned around to show signs of life again. We still see a significant amount of resistance at

The New Zealand dollar initially fell during the week, but turned around to show signs of life again. We still see a significant amount of resistance at the 0.70 level, and therefore I think that the market will probably consolidate more than anything else. That’s not to say that we can break out, and obviously a move above the 0.70 level would be important, perhaps sending in the market towards the 0.72 level over the longer term. Keep in mind that the New Zealand dollar needs some type of external force to make it rise most times, and that external force is typically a “risk on” attitude to the overall financial markets around the world. Currently, we don’t necessarily have that, as markets have been choppy. However, that could change at the drop of a dime as you know.

If we break down below the 0.68 handle, that is a market moving event in my estimation, perhaps sending this market as low as the 0.64 level over the longer term. The New Zealand dollar has been sold off rather violently after the election of the most recent prime minister, which is believed to be a heavy spender. It’s difficult to know whether it is overdone, but certainly it is a market that has been negative, and until proved otherwise, I must assume that it will continue to be. I believe that the markets will continue to see choppiness, but an overall negative headwind. Because of this, I am looking to shorter-term charts for selling opportunities below the 0.70 level, which I think is going to offer a significant amount of selling pressure. A breakdown below the 0.68 handle would have me and more of a “sell and hold” scenario, and looking to add to the position as we broke down.

NZD/USD Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement