Advertisement

Advertisement

Other Potential Outcomes From Quantitative Tightening by the Federal Reserve

By:

Their intended goal is to successfully reduce inflation and soft economic landing simultaneously.

Key Fundamentals

The Federal Reserve’s monetary policy composed of aggressive rate hikes in tandem with a balance sheet reduction is intended to achieve price stability through lower inflation. The Federal Reserve is assuming that it can effectively reduce inflation without creating a recession. While this is one possible outcome, at best achieving this goal will be exceedingly difficult, and at worst impossible to accomplish.

Russia’s invasion of Ukraine has had a profound impact on commodity prices, supply chains, inflation, and a steep contraction of global growth. The impact of Russia’s war is that the Federal Reserve can only impact core inflation resulting in no major real reduction of inflation and an economic contraction. Therefore, a key risk to the global economy is the possibility that inflation will remain persistent and elevated together with contracting economic growth, the definition of stagflation.

Currently, inflation globally continues to run exceedingly hot. Today the European Union reported that inflation hit a new record in June. Headline inflation in Europe came in at 8.6% YoY exceeding the inflation level of the United States which is at 8.3% (CPI reading for May). Inflation in advanced economies is currently at its highest levels recorded during the last 40 years.

Global growth rebounded to 5.7% in 2021, however majority of the global growth that occurred in 2020 and 2021 was supported by global fiscal and monetary policy accommodation. Because this accommodation has ended economic growth is expected to contract to 2.9% in 2022. More alarming is the high probability that global growth will continue to contract with little change in 2023.

Today the Brookings institution released an in-depth study about how “Today’s global economy is eerily similar to the 1970s,”. This study acknowledged that “the global economy is in the midst of a sudden slowdown accompanied by a steep run-up in global inflation to multidecade highs. These developments raise concerns about stagflation—the coincidence of weak growth and elevated inflation—similar to what the world suffered in the 1970s.”

This study sites that the current supply shocks occurred after the prolonged monetary policy accommodation led to pent-up demand in conjunction with the recent global supply shock in food and energy costs due to Russia’s invasion of Ukraine. According to the study the global economy faces challenges that are similar to the oil shocks that occurred in 1973 and 1979-80. The study concludes that just as in the 1970s the global economy could be thrust into a period of stagflation.

There are multiple possible outcomes from global central banks and the Federal Reserve’s monetary tightening. Their intended goal is to successfully reduce inflation and soft economic landing simultaneously. While this is the desired outcome, it will be the most challenging possible outcome to achieve. There is a real risk that their actions will lead to persistent and high inflation combined with economic stagnation.

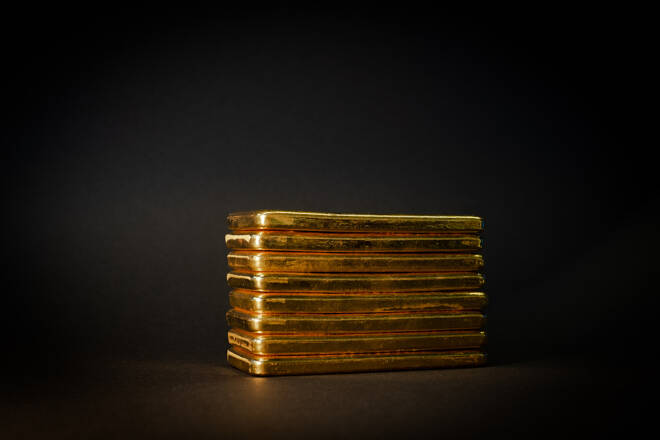

Impact on Gold

If the global economy moves into a period of stagflation this will certainly create strong bullish undertones for gold prices. This can be seen in today’s price action in gold. Gold futures traded to a low last night of $1783.40 and is currently fixed at $1812.12 indicating a dynamic pivot and possible key reversal. We could be witnessing market participants focusing on the real possibility that the monetary policy of central banks globally will lead to stagflation rather than their intended goal of lowering inflation.

For those who would like more information simply use this link.

Wishing you as always good trading,

Gary S. Wagner

About the Author

Gary S.Wagnercontributor

Gary S. Wagner has been a technical market analyst for 35 years. A frequent contributor to STOCKS & COMMODITIES Magazine, he has also written for Futures Magazine as well as Barron’s. He is the executive producer of "The Gold Forecast," a daily video newsletter. He writes a daily column “Hawaii 6.0” for Kitco News

Advertisement