Advertisement

Advertisement

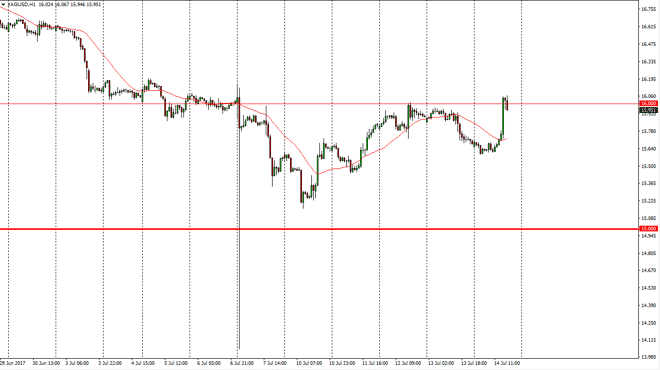

Silver Forecast July 17, 2017, Technical Analysis

Updated: Jul 15, 2017, 07:13 GMT+00:00

Silver markets went sideways initially during the day on Friday, and then broke above the $16 level. We have found the area to be massively resistive

Silver markets went sideways initially during the day on Friday, and then broke above the $16 level. We have found the area to be massively resistive though, and it looks as if the market is going to continue to struggle to break above there. It’ll be interesting to see what happens next, but I think if we can break above the $16.20 level, that would bring and up bullish pressure into this market to bring in more buyers. Until we get above there, I’m not necessarily convinced that we are going to go much higher. If we pull back, we will probably find support at the beginning of the day, which is closer to the $15.65 level. Ultimately, this is a market that has been very choppy, but if we cannot continue higher, and looks as if we may be able to roll over.

US dollar

Pay attention to the US dollar, as it has a negative correlation to the gold markets. Ultimately, this is a market that should continue to be volatile, because it will fall in line with the expectation of the Federal Reserve, which is a bit murky to say the least. I think that Silver also will continue to play little brother to the gold markets, so keep in mind that gold markets will probably be the first sign of which direction we should be going in the silver market. I think that a pullback is probably much more likely that a breakout, but I’m not necessarily thinking that were going to fall very far either. I think the back and forth choppiness continues, even though we have seen quite a bit of bullish pressure in reaction to the economic announcements coming out of America on Friday. To trade this market, you will need to be nimble.

SILVER Video 17.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement