Advertisement

Advertisement

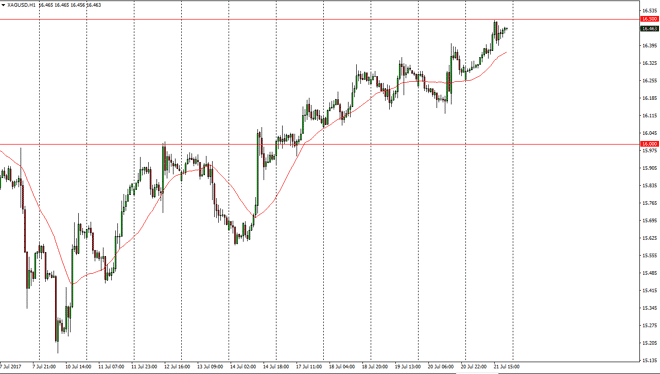

Silver Forecast July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:04 GMT+00:00

Silver markets continue to show positivity during the day on Friday, as we slammed into the $16.50 level. That is an area of resistance, but I think that

Silver markets continue to show positivity during the day on Friday, as we slammed into the $16.50 level. That is an area of resistance, but I think that it’s only a matter of time before we break above there and continue to go towards the $16 level. I think that pullbacks offer value in a market that is benefiting from a softer US dollar, and should continue to. I believe that the 24-hour exponential moving average is continuing to show signs of support as well, so on a breakout above the $16.50 level, I am a buyer pullback as that area should now be massively supportive. Because of this, the market should continue to go towards the $17 level over the longer term, and by longer-term, I mean several days.

Short-term pullback? Think value.

It’s possible that we get a short-term pullback from this level, but I think it’s only a matter of time for the buyers jump back into the market and taking advantage of value. I believe that the market will continue to be rocky and jagged, but given enough time I do believe that the buyers continue to go higher. I have no interest in shorting this market, I believe that the currency headwinds will continue to favor the precious metals markets. I think given enough time, we will continue to reach towards the $18 level above. That’s going to take a significant amount of bullish pressure to get there, but silver market certainly is benefiting lately, and I think that will continue.

SILVER Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement