Advertisement

Advertisement

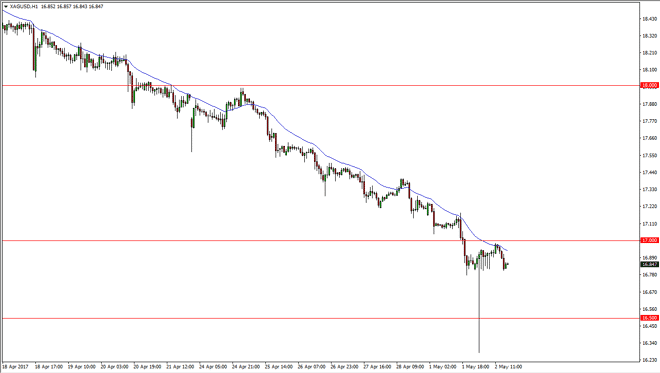

Silver Forecast May 3, 2017, Technical Analysis

Updated: May 3, 2017, 03:40 GMT+00:00

The Silver markets continue to grind sideways during the Tuesday session, below the psychologically important $17 level. This is an area that of course

The Silver markets continue to grind sideways during the Tuesday session, below the psychologically important $17 level. This is an area that of course attracts a lot of attention, and the $16.75 level underneath seems to be supportive. However, there are a lot of issues surrounding precious metals overall, and it makes quite a bit of sense that the geopolitical risks continue to take center stage. The 24-hour moving average has been very reliable as of late, and it appears if it continues to point in a general downward movement, it’s likely that we will see sellers. Nonetheless, I do see an opportunity to go long if a couple of things happen.

A break above the $17 level would be the first thing that I would need to see the start buying silver, and more importantly I would rather see you move above the $17.15 level. I would also need to see the 24-hour moving average turn to the upside, and that would perhaps signal that Silver markets are done selling off. Longer-term, this market looks very likely to find support underneath, but I believe if we break down below the $16.50 level underneath, it could be a sign that we are going to go much, much lower. Currently though, I think that this is just a gentle pullback that we have seen over the last several days and can continue to be taken advantage of. Keep your leverage low, and the CFD markets of course are perfect vehicle for doing that as Silver markets tend to get very erratic. Once we break above the $17.15 level, I think the market would probably go looking for the $17.50 level above there. A breakdown from here, that could send this market looking for $16 longer term.

SILVER Video 03.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement