Advertisement

Advertisement

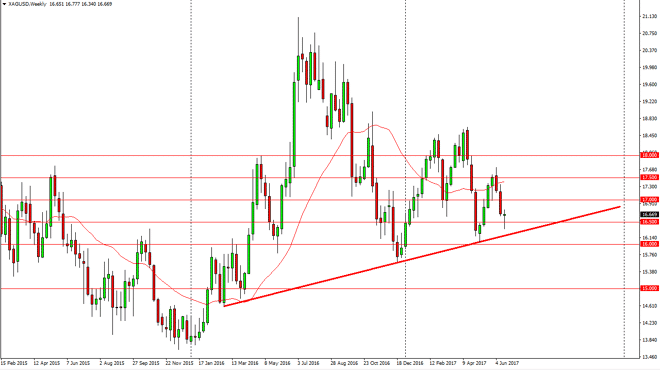

Silver forecast for the week of June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:15 GMT+00:00

Silver markets initially tried to rally during the week but then rolled right back over to test the uptrend line just below. We ended up bouncing above

Silver markets initially tried to rally during the week but then rolled right back over to test the uptrend line just below. We ended up bouncing above the $16.50 level, which of course is a bullish sign. Even more bullish is the hammer that we formed for the weekly candle, and a break above the top of the candle should send the market towards the $17 level above, and the $17.50 level after that. Longer-term, looks as we will probably continue to find buyers in this area, as we continue to see upward pressure. I don’t have any interest in selling silver, it appears that it continues to attract money. The longer-term outlook for silver is bullish as far as I can see, but there’s obviously going to be a massive amount of volatility.

Baby steps

This market continues to be one that rallies, but I think that short-term and small position should continue to be the way to go going forward. We should essentially take “baby steps” in a market that is going to be very volatile, but I think that longer-term this is a market that offers the opportunity to pick up silver on the cheap and build up larger positions. Ultimately, the market should then go to the $20 handle after that, and with this being the case it’s likely that the market will build up over time. Because of this, adding small positions along the way is probably the way to go forward, as the concerns around the world continue. If the US dollar falls, that should continue to support gold and silver both, so obviously this is a market that could have several reasons to rally. I don’t like selling unless we break down below the $16 handle.

SILVER Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement