Advertisement

Advertisement

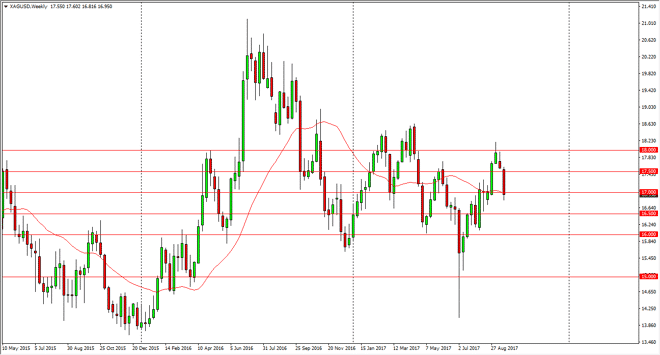

Silver forecast for the week of September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:09 GMT+00:00

Silver markets fell during the week as the US dollar continues to pick up strength. This was especially true once the Federal Reserve announced that it

Silver markets fell during the week as the US dollar continues to pick up strength. This was especially true once the Federal Reserve announced that it was going to start shrinking its balance sheet, thereby enacting a form of monetary tightening. With that, precious metals tend to fall as the US dollar strengthens. We have been rejected above at the $18 level, and this week was only a continuation of the bearish pressure. Now that we have broken below the $17 level, I think that we will see sellers in this area, and a break below the bottom of the candle stick should send this market looking for the $16.50 level underneath. If we can break down below there, we probably go to $16 rather quickly. Overall, this is a market that looks like it has been consolidating for several months now, and were just simply taking the return trip to the bottom.

I don’t have any interest in buying silver right now, because quite frankly if I was going to buy some type of precious metal, it would be cold. Silver just doesn’t have the legs to go higher like that. I think that a supportive candle near the $16 level might be a nice buying opportunity, but until we get that I will probably remain on the short side if any side. Silver continues to be at the mercy of the Federal Reserve and the US dollar, both of which are showing none. I believe in the long term buying and holding of silver, so perhaps the dip down to $16 might be a great catalyst for doing that. However, from a leveraged standpoint you do not want to be on the wrong side of this trade as Silver markets are extraordinarily volatile and punishing.

SILVER Video 25.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement