Advertisement

Advertisement

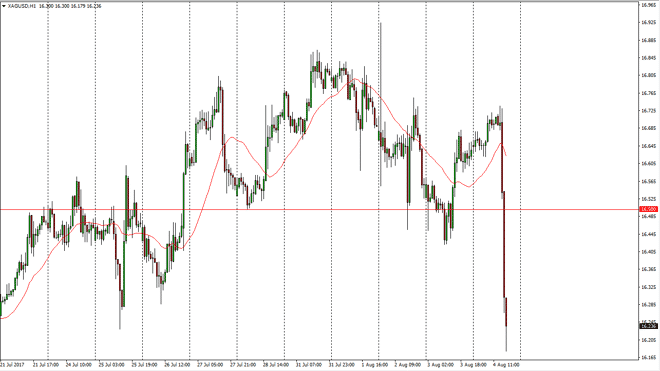

Silver Price Forecast August 7, 2017, Technical Analysis

Updated: Aug 5, 2017, 05:31 GMT+00:00

Silver markets initially went sideways during the day on Friday, but then collapsed as the jobs number came out much stronger than anticipated in the

Silver markets initially went sideways during the day on Friday, but then collapsed as the jobs number came out much stronger than anticipated in the United States. This put the US dollar higher, and that put a lot of pressure on Silver markets. By slicing through the $16.50 level the way we did, I believe that there is significant bearish pressure and that rallies at this point will be sold. If we do rally to the $16.50 level, I think it would be a nice selling opportunity. It’s not until we break above the $16.75 level that I would consider buying, because it would wipe out the selling pressure and show such a resiliency that I think most of the trading world would stand up and take notice.

Selling rallies

I still believe that selling rallies will be the best way to go, as the US dollar picking up strength is going to put pressure on most commodities, and Silver seems to be very sensitive to this. I believe that the $16 level will probably be the first target, and then perhaps the $15.50 level after that. In the unlikely event that we do breakout to the upside, I believe that Silver would continue to go much higher, as it would show a massive amount of resiliency and strength. However, I believe that the move during the day on Friday is probably enough to scare most traders from going into the market and start adding size to any position may have. I believe that the market will remain volatile, but I still favor the downside in general. Keep your position size small, this is going to be a very dangerous market to be involved in over the next couple of sessions as the volatility picks up.

SILVER Video 07.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement