Advertisement

Advertisement

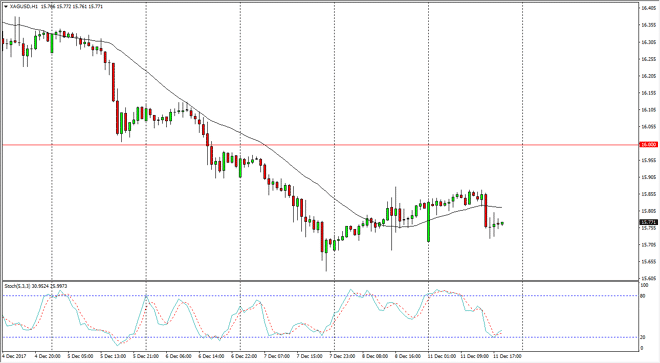

Silver Price Forecast December 12, 2017, Technical Analysis

Updated: Dec 12, 2017, 06:06 GMT+00:00

Silver markets continue to look a bit soft, as we chop around the $15.75 region. This market continues to await the Federal Reserve meeting on Wednesday.

Silver markets continue to be very noisy, as they typically are. The $15.75 level looks as if it is offering support, perhaps a buying opportunity to reach towards the $16 level above. However, I believe that this market will be relatively quiet for the next 48 hours, as we get a vital Federal Reserve interest rate hike coming on Wednesday, and more importantly, the statement the comes afterwards. That statement looking more hawkish than dovish should be very bullish for the US dollar, and could send Silver much lower. Of course, the exact opposite could be true, and if the Federal Reserve looks softer than originally thought, then the market would probably serve buying precious metals, silver included and should send the market towards the $16 level above.

The noise will continue, and quite frankly I feel that the Silver markets are probably best traded in its physical form, or at least in the options market so you can mitigate some of the danger in the futures market. If we get some type of geopolitical action that causes a lot of fear, that could push Silver markets higher as well, but right now that does not look likely. I think that the Silver markets will continue to be in the background when it comes to precious metals, as there seems to be much more interest in the gold markets. Currently, I think that we are probably going to see very little in the way of volatility, at least not until that statement comes out. I am still bullish of silver longer-term, and therefore continue to buy silver bullion.

SILVER Video 12.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement