Advertisement

Advertisement

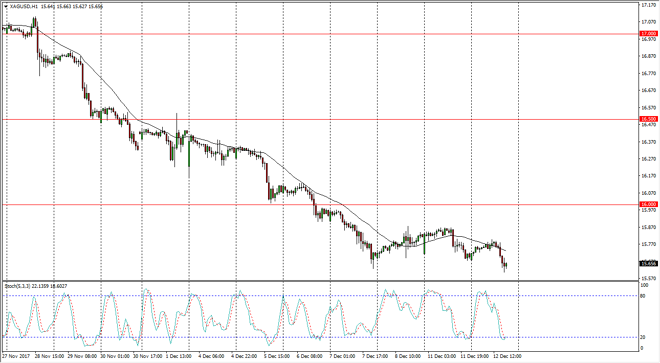

Silver Price Forecast December 13, 2017, Technical Analysis

Updated: Dec 13, 2017, 06:13 GMT+00:00

Silver markets fell slightly during the trading session on Tuesday, dipping down towards the $15.60 level. However, with the Federal Reserve coming out with an announcement today, it’s likely that we will see a very quiet market between now and then.

I think Silver markets will continue to be very volatile, but between now and the interest rate announcement coming out of the United States, probably quiet. I think that the Federal Reserve interest rate statement will be crucial, and the Silver markets will react according to the hawkish or dovish attitude of the Federal Reserve. If the Federal Reserve looks to be hawkish, that will continue the bearish pressure pond Silver, and could send the market looking towards the $15 level underneath which is massively supportive on the longer-term charts. However, if the Federal Reserve is more dovish than anticipated, it’s likely that Silver will rally, perhaps reach towards the $16 level.

The markets will continue to be volatile, but between now and the announcement, I would stay away from Silver. In fact, I would wait for a daily close above $16 to start buying silver, or a daily close below $15.50 to start shorting. It’s probably easier to trade the gold markets, but if you do find yourself trading Silver, I believe that longer-term buy-and-hold trading is possible with physical silver, therefore eliminating the potential for trouble when it comes to leverage. I like buying silver, and have been doing so for some time. By taking your time in building a physical stature gold, you can benefit from the inevitable swing in the value of currencies over the longer term. Remember, silver tends to work in an inverse correlation to the US dollar, as all precious metals do eventually.

SILVER Video 13.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement