Advertisement

Advertisement

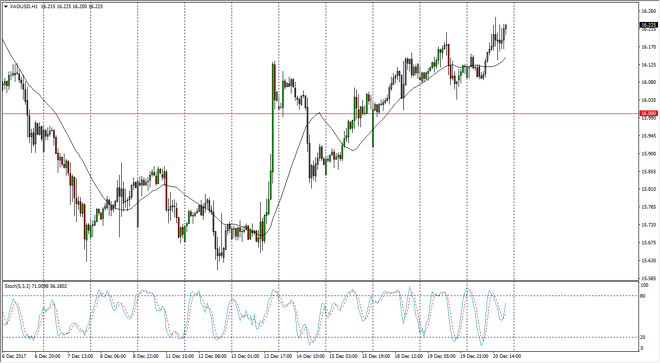

Silver Price Forecast December 21, 2017, Technical Analysis

Updated: Dec 21, 2017, 05:59 GMT+00:00

Silver markets rallied a bit during the trading session on Wednesday, as we are testing the $16.25 level. A break above there should send this market much higher, as it would be another hurdle that the buyers have overcome.

Silver markets initially tried to pull back during the trading session on Wednesday, but found enough support to turn things around and reach towards the $16.25 handle. I think if we can break above there, the market should then go to the $16.50 level. Silver markets continue to be very noisy, but I think certainly have more of an upward proclivity based upon the longer-term chart. I believe that the markets will ultimately go looking towards the $18 handle, but obviously it’s going to take a while to achieve that goal. This will be especially true during this time of year, as the volume simply is not there as traders focus on holidays, and not markets.

Buying dips continues to be the best way to trade this market, and I believe that the $16 level below is going to act as a “floor” in this market, so if we can stay above there I am going to remain positive. I think it will be very choppy and difficult, but given enough time we will find plenty of reasons to go higher. Silver markets are probably easier to trade from a physical standpoint, and without leverage, but at the end of the day I think if you are careful about the way you leverage your position, you could take advantage of this in the CFD markets as well. If we can break above the $18 level, that would be a longer-term move just waiting to happen as well. I have no interest in shorting this market anytime soon, because we are towards the bottom of the overall consolidation from my longer-term standpoint.

SILVER Video 21.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement