Advertisement

Advertisement

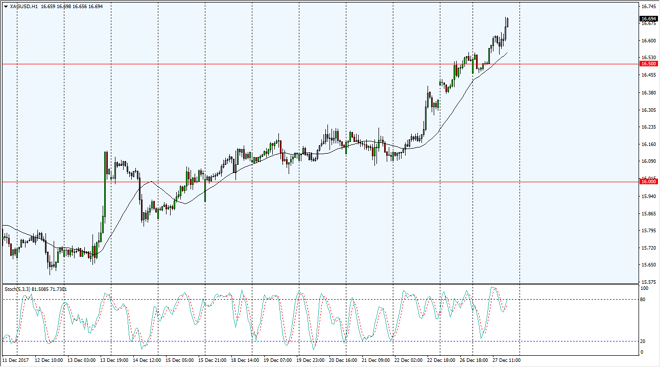

Silver Price Forecast December 28, 2017, Technical Analysis

Updated: Jan 23, 2018, 08:52 GMT+00:00

Silver markets rally during the trading session on Wednesday, breaking above the $16.50 level, and showing that the US dollar is starting to soften yet again.

The Silver markets rally during the trading session on Wednesday, breaking above the $16.50 level. By breaking above there, the market looks ready to go much higher, perhaps aiming towards the $17 level next. There is a minor resistance level at the $16.75 handle, and I think that any pullback from there will probably be the buying opportunity that the bullish traders are waiting for. I think there should be a significant amount of support near the $16.45 level, and of course the gap from a few days ago which is roughly $16.35 or so.

I don’t have any interest in shorting this market, it looks hell-bent on going to the $17 level, and as the momentum has built quite nicely, I’m even comfortable trading the futures market although they can be a bit volatile this time a year. CFD markets work as well. Ultimately, I think that pullbacks offer value and I think that the selling of silver is going to be very difficult to do until we break down below the $16.25 level at the very least. Volatility of course will be an issue, but it looks as if the US dollar is falling against almost everything out there right now, so of course Silver will be the same. We also have a lot of geopolitical headlines just waiting to happen out there, and that could have people piling into precious metals overall. I think it looks as if the market is trying to tell us where it wants to go early next year, so jumping in now in building up as the market proves you correct is probably the best way to go about this.

SILVER Video 28.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement