Advertisement

Advertisement

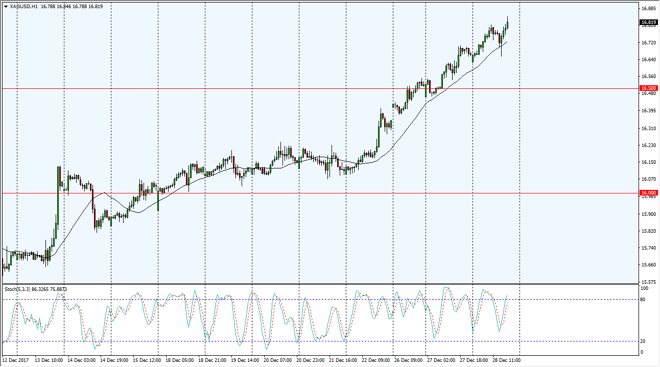

Silver Price Forecast December 29, 2017, Technical Analysis

Updated: Dec 29, 2017, 04:55 GMT+00:00

The Silver markets were bullish during the trading session on Thursday, as the US dollar continues to get beaten up. Ultimately though, I think that precious metals are going to continue to rally, so therefore I like the idea of buying dips.

Silver markets rally during the trading session on Thursday, reaching as high as the $16.75 level, but then pulled back enough to reach towards the $16.65 level before bouncing again. Silver has rallied for a while now, as the US dollar is getting beaten up, and that of course is good for precious metals in general. The $17 level above is a target, and I think it is also resistance. In the short term, I like buying short pullbacks that show signs of a bounce and add to a position as it works in my favor. It’s not until we break down below the $16.50 level that I would be concerned about the market, and therefore I remain very bullish and positive. If we did breakdown below the gap at $16.40 level, that would be very negative and could send this market down to the $16.10 level.

However, I think that is very unlikely to happen and with the US dollar looking very soft against other currencies around the world, it makes sense that precious metals priced in those same US dollars should gain. Beyond that, we have the potential geopolitical headlines that should send this market higher as well, should they come. I think the market will continue to be very choppy this time of year, but with the action that we have seen lately, I’m comfortable jumping in the futures market, even though they can be very expensive. If you don’t have access to the futures market, CFD markets can work as well.

SILVER Video 29.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement