Advertisement

Advertisement

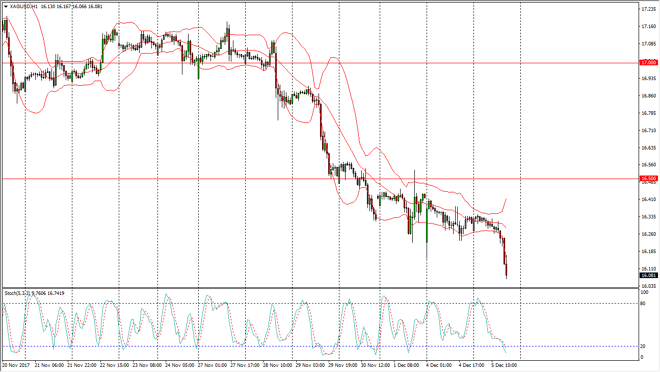

Silver Price Forecast December 6, 2017, Technical Analysis

Updated: Dec 6, 2017, 06:57 GMT+00:00

Silver markets continue to fall significantly as the US dollar has gotten a bit of relief due to tax reform being on its way. It now looks as if the marketplace is betting on Congress to get its job done, and therefore the US dollar can continue to gain.

With the US dollar gaining in general, the Silver markets have rolled over a bit during the trading session on Tuesday in early action. The market reaching down towards the $16 level makes a lot of sense, because quite frankly it was the next support level. As we approach the $16 level it will be interesting to see if we can get some type of bounce, but I think that bounce should be a selling opportunity eventually, and as I look at the stochastic oscillator on the hourly chart, I can see that we are starting to cross in the oversold area. It is because of this that I am waiting for the bounce to start shorting again. I suspect that the $16.25 level above has potential to be resistance, because it was support recently. I think that any bounce towards that area that show signs of weakness should be jumped upon.

Alternately, if we were to break down below the $16 level, I think the market then would make a beeline towards the $15.50 level next. This is a market that will continue to be bearish if the American dollar appreciates, but given enough time I think that we will eventually see a large “floor” closer to the $15 level. A breakdown below there would of course be very negative, and could send this market much, much lower. However, I suspect that somewhere near $15 there will be a significant stand made. Longer-term traders continue to hold physical silver.

SILVER Video 06.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement