Advertisement

Advertisement

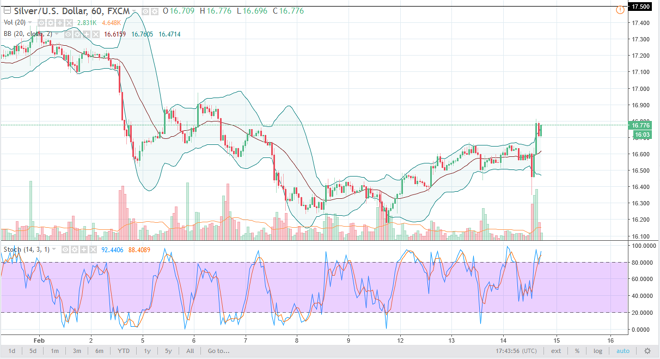

Silver Price Forecast February 15, 2018, Technical Analysis

Updated: Feb 15, 2018, 04:51 GMT+00:00

Silver markets were very noisy during the session on Wednesday, as the US dollar was extraordinarily volatile. The CPI numbers came out stronger than expected, driving the value the greenback higher. However, traders turned around and sold it all, lifting precious metals as a result.

Silver markets were very noisy on Wednesday, initially going sideways, then fell as the CPI numbers in the United States showed that the Federal Reserve is very likely to raise interest rates considering that they are seen inflation. However, precious metals rallied as the greenback fell, and it looks likely that we are going to go reaching towards the $17 level above in the silver market, and then eventually the $17.50 level. The Silver markets tend to move opposite of the dollar, and if the US dollar continues to fall, that should bring plenty of money into the precious metals sector in general. Silver also tends to follow gold, but is a lot thinner volume wise than gold, so I think that the gold markets must be followed as well. Underneath, the $16 level is the “floor” in the market, and I think that eventually we will go much higher.

My longer-term target is $20, but I recognize that there are lot of barriers between here and there every $0.50 handle. I believe buying dips continues to be a good way to play the silver market but leverages a killer when it comes to this contract as the futures market is extraordinarily expensive. Because of this, I buy the dips in small increments, and recognize that there is an argument to be made for holding a longer-term core position. Adding every time, we dip is probably the best way to go, but doing so incrementally will keep you out of a lot of trouble.

SILVER Video 15.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement