Advertisement

Advertisement

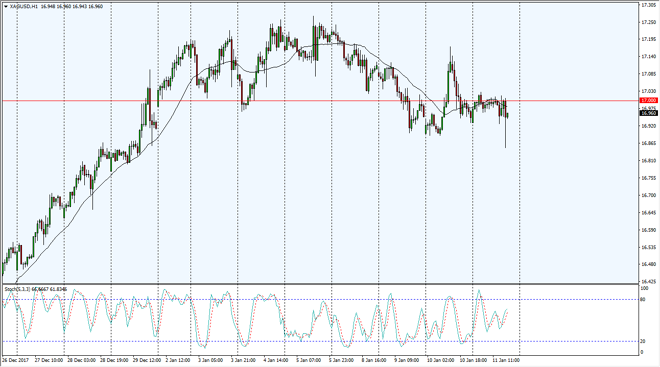

Silver Price Forecast January 12, 2018, Technical Analysis

Updated: Jan 12, 2018, 04:59 GMT+00:00

Silver markets were choppy during the trading session on Thursday, as we continue to bounce around the $17 level. This level has offered a certain amount of resistance during the trading session, but I think if we can break above there, the market will probably go looking towards the $17.25 level.

Silver markets were choppy during the trading session on Thursday, as we have gone back and forth. I think that the $17 level continues to be rather important, as it is a large, round, psychologically significant number. If we can break above there, the market then will go to the $17.25 level. I think that the $16.85 level has offered a significant amount of support, and if we were to break down below there, we could probably go lower, perhaps reaching towards the $16.50 level. This is a market that continues to be influenced heavily by the US dollar, which has been struggling as of late. I think that the market will eventually break above the $17.25 level, and then eventually go looking towards the $17.50 area.

I believe that the volatility will continue to be an issue in this market, so be careful in trading sewer, or at the very least, take some of the leverage out of the equation. Either use a small position in the CFD markets, or perhaps physical silver to take advantage of the market. Longer-term, I believe that the market is going to go looking towards the $20 handle above, but that is most certainly a longer-term aspiration, something that could take a couple of years. Ultimately, this is a market that I believe offers “buy on the dips” scenario’s, but you need to be careful about trade size, so you can ride out what will be massive volatility.

SILVER Video 12.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement