Advertisement

Advertisement

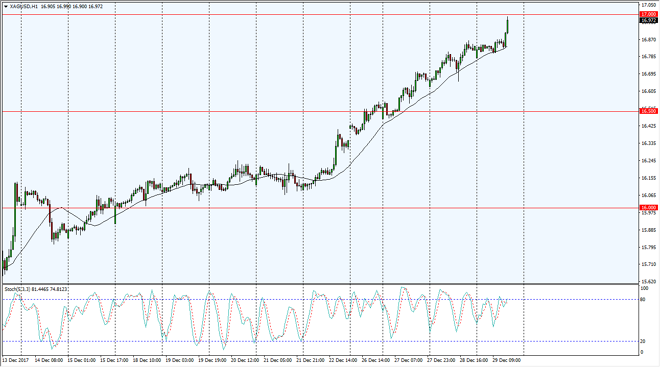

Silver Price Forecast January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:14 GMT+00:00

Silver markets rallied significantly in thin trading on Friday, testing the $17 level. I think it’s relatively clear at this point that if we can break above the $17 level, silver should continue to go much higher.

Silver markets initially went sideways during the thin trading on Friday, but it is obvious that we are trying to break above the $17 handle. If we can clear that level, I think the next target will be $17.25, followed very quickly by $17.50 after that. Short-term pullbacks continue to be buying opportunities, as the Silver markets have been rather strong, with the 24-hour exponential moving average offering nice dynamic support. As I record this, it looks as if we are trying to break through the resistance above, and we may have just run several stop levels. Now that has happened, it will be easier to go to the upside.

Alternately, if we pull back from here I would anticipate that the $16.75 level should offer plenty of support, and could be an area the start buying from as well, as it is an area that has been resistive and coincides nicely with the moving average that I have been following. Either way, selling silver is almost impossible at this point, and I am comfortable using a leverage position, something that I don’t do lightly with silver, as it tends to be very volatile. Ultimately, this is a market that should perform quite well for the new year, and I think at this point, we are probably looking for a move towards the $18 level over the longer term, as the US dollar has been very soft lately, not only in this market, but in most currency markets as well. For what it’s worth, gold has already broken out above a major resistance barrier, and typically Silver will follow.

SILVER Video 02.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement